- Home

- Advertise With us

- World News

- Tech

- Entertainment

- Travels & Tours

- Contact US

- About us

- Privacy Policy

Top Insights

How (and why) to combine your Chase Ultimate Rewards points into a single account

Editor’s note: This is a recurring post, regularly updated with new information and offers.

Chase’s Ultimate Rewards program can offer some incredible value. It’s no surprise that the currency appears near the top of TPG’s July 2025 valuations, checking in at 2.05 cents per point each.

One of the best things about the Ultimate Rewards program is how flexible the points are, not only when it comes to your redemption options, but also when you’re looking to transfer points between your Chase credit cards.

In fact, it’s among the most consumer-friendly transferable points programs out there. By combining Ultimate Rewards points into a single account, you can maximize the value you get out of every redemption.

With solid offers across Chase’s product portfolio, including the popular [applyLink pid=”22125056″ overridetext=”Chase Sapphire Preferred® Card”] (see [termsConditions pid=”22125056″ overridetext=”rates and fees”]), now could be the perfect time to familiarize yourself with this strategy for maximizing your Chase points.

So, here’s a tutorial on how to transfer Ultimate Rewards points between accounts and a look at when to consider doing so.

Overview of the Chase Ultimate Rewards program

Before we get started, here’s a list of the major cards that participate in the Ultimate Rewards program:

- [applyLink pid=”221211836″ overridetext=”Chase Sapphire Reserve®”] (see [termsConditions pid=”221211836″ overridetext=”rates and fees”])

- [applyLink pid=”22125056″ overridetext=”Chase Sapphire Preferred Card”]

- Chase Freedom (no longer available to new applicants)

- Chase Freedom Flex®

- [applyLink pid=”221211281″ overridetext=”Chase Freedom Unlimited®”] (see [termsConditions pid=”221211281″ overridetext=”rates and fees”])

- [applyLink pid=”221211974″ overridetext=”Ink Business Preferred® Credit Card”] (see [termsConditions pid=”221211974″ overridetext=”rates and fees”])

- [applyLink pid=”22125825″ overridetext=”Ink Business Cash® Credit Card”] (see [termsConditions pid=”22125825″ overridetext=”rates and fees”])

- [applyLink pid=”6218″ overridetext=”Ink Business Unlimited® Credit Card”] (see [termsConditions pid=”6218″ overridetext=”rates and fees”])

- [applyLink pid=”10965″ overridetext=”Chase Sapphire Reserve for Business℠”] (see [termsConditions pid=”10965″ overridetext=”rates and fees”])

The information for the Chase Freedom and Chase Freedom Flex has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

(Note that the [applyLink pid=”8489″ overridetext=”Ink Business Premier® Credit Card”] (see [termsConditions pid=”8489″ overridetext=”rates and fees”]) is also issued by Chase, but you can’t combine those rewards with other cards. They can only be redeemed for cash back.)

Savvy readers out there may notice that there are five cash-back cards included on this list (the three Freedom products, along with the Ink Cash and the Ink Unlimited).

While it’s true that these cards officially earn cash-back rewards, they still fall under the Ultimate Rewards program. They become particularly valuable when you hold them in conjunction with the Chase Sapphire Reserve, the Chase Sapphire Preferred or the Ink Business Preferred.

That’s because you can combine the rewards you earn across all your Ultimate Rewards cards into a single account. As such, you can convert all the rewards earned by these cash-back cards into fully transferable Ultimate Rewards points if you have a Sapphire Reserve, Sapphire Preferred or Ink Business Preferred.

This is the enduring power of my favorite combination of credit cards, which I like to call the “perfect Chase quartet”:

| Card | Bonus categories |

Annual fee |

| applyLink pid=”221211836″ overridetext=”Chase Sapphire Reserve”] |

|

$795 |

| Chase Freedom Flex (or Chase Freedom) |

|

$0 |

| [applyLink pid=”22125825″ overridetext=”Ink Business Cash Credit Card”] |

|

$0 |

| [applyLink pid=”221211281″ overridetext=”Chase Freedom Unlimited”] |

|

$0 |

However, the ability to combine your points isn’t limited to your own accounts. You can do this with a household member as well.

When it comes to combining Ultimate Rewards points, there are two different types of transfers you can make:

1. Transfer points between two accounts where you’re the primary cardholder.

2. Transfer points between an account where you’re the primary cardholder and one where someone else is the primary cardholder.

Here’s a step-by-step look at each of these scenarios.

Related: How much are Chase Ultimate Rewards points worth?

How to set up your Ultimate Rewards account

The first thing you’ll need to do is ensure that your Ultimate Rewards-earning credit cards are all associated with the same online account. If you haven’t set up online access, start on the Chase website and click “Not enrolled? Sign up now” on the right-hand side of the page.

If you already have a Chase account and applied for a new Ultimate Rewards card, it should automatically appear shortly after getting approved. To make sure, log in to your account and click on “Account Activity.” Scroll down and look for the new card.

Note that you can have other (non-Ultimate Rewards) accounts associated with the same Chase username. I currently have several others on the same online account, making it easier to manage all my cards.

Related: The power of the Chase Trifecta: Sapphire Reserve, Ink Preferred and Freedom Unlimited

How to combine Chase Ultimate Rewards points

Once you set up your online account, the process for both types of transfers begins the same. Start by logging in to the Chase account from which you want to transfer points — be it yours or a household member’s account. Click on an Ultimate Rewards card from the homepage, then click “Redeem” next to your rewards balance.

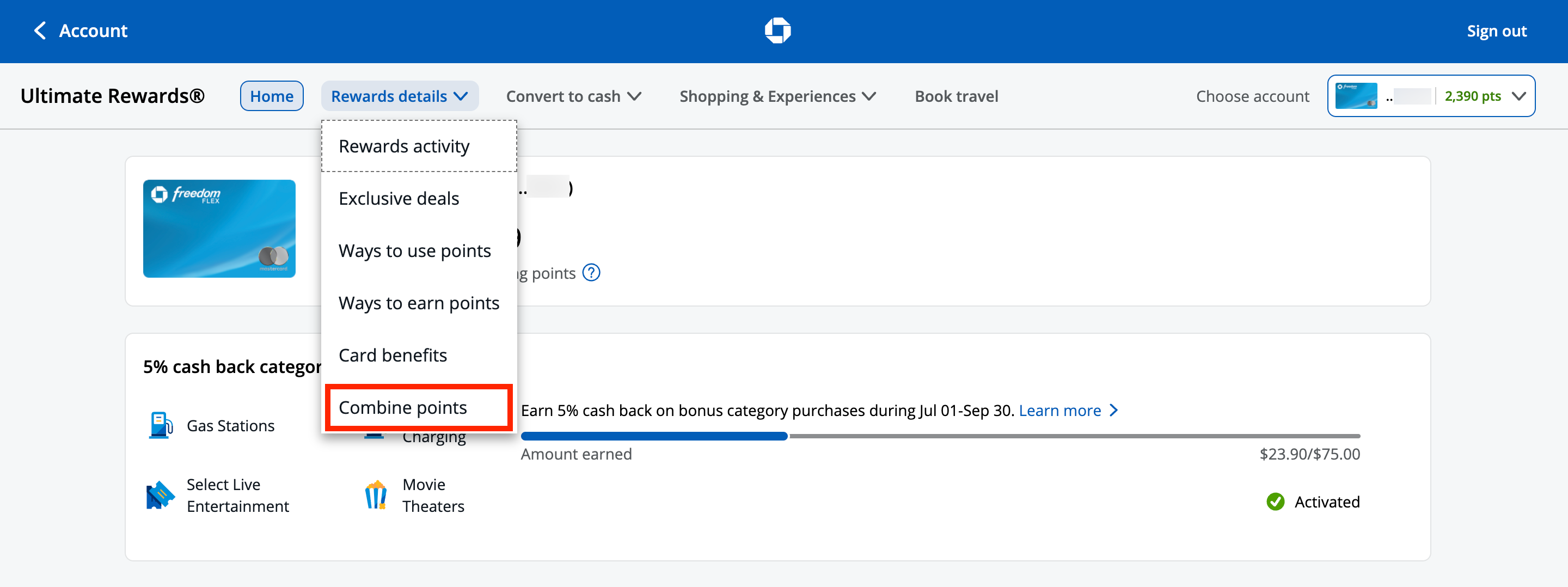

This will launch the Ultimate Rewards portal. At the top, click on “Rewards details” to see the “Combine points” option.

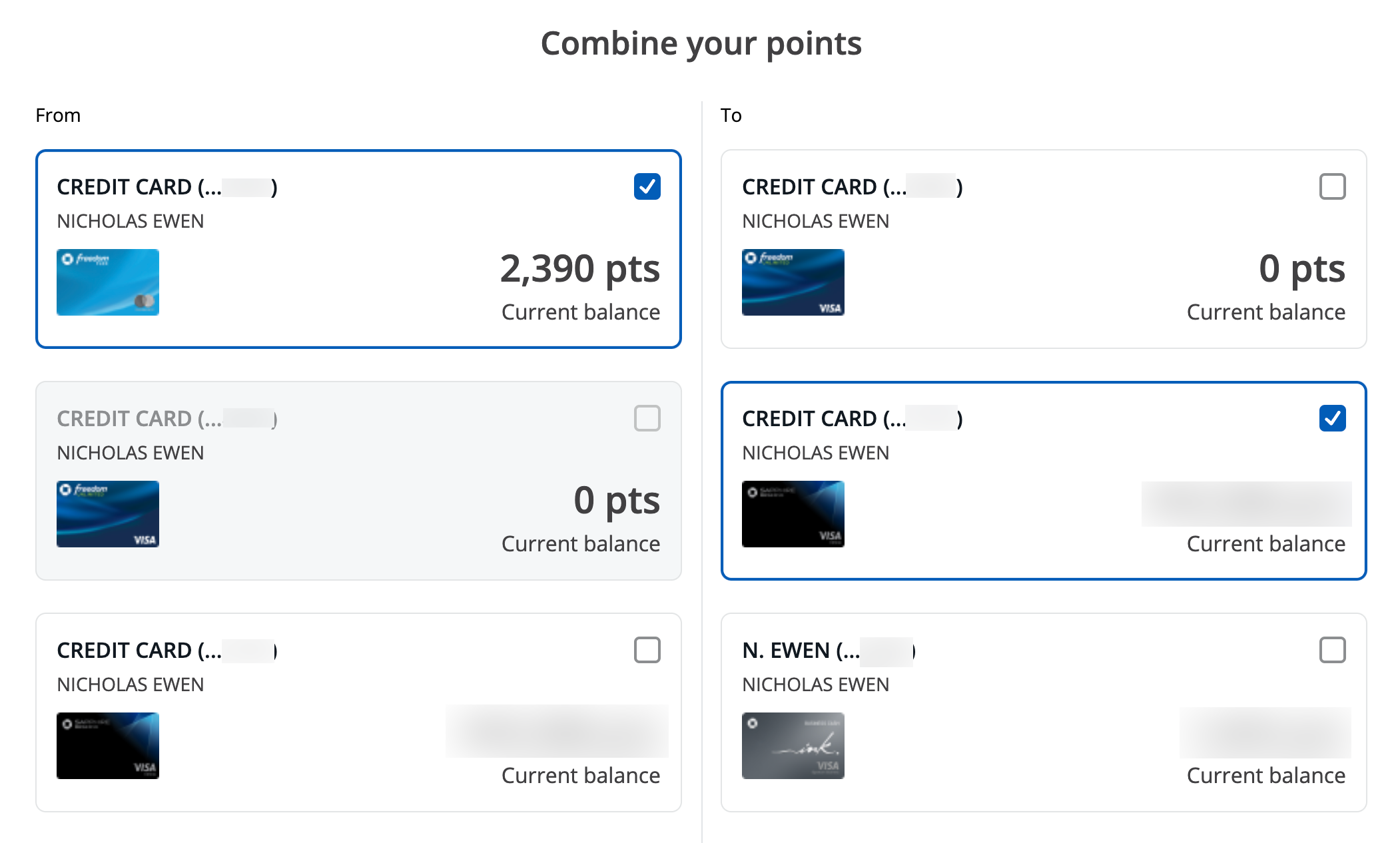

Here is where things start to differ, depending on whether you’re combining points from two of your accounts or if you want to transfer your points to someone else. The easier of the two involves combining points on two accounts where you’re the primary cardholder on both accounts.

How to transfer Chase points between your cards

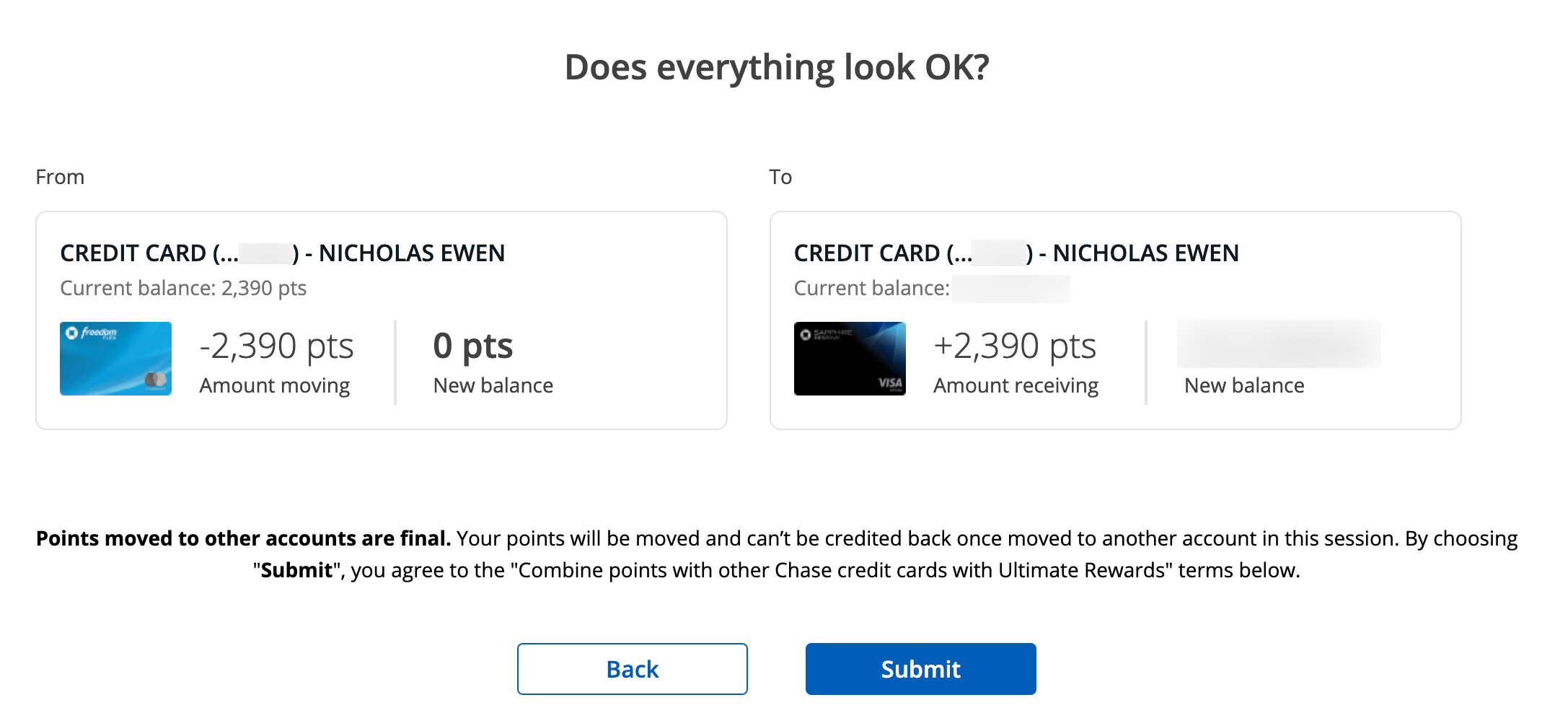

After clicking the “Combine points” option, choose the account from which you want to transfer your points and the account where you’d like the points deposited. Note that in this screenshot, I’m transferring points from my Chase Freedom Flex to my Chase Sapphire Reserve.

Card art may differ for Sapphire Reserve cardholders who applied on or after June 23, 2025.

Then click “Next” at the bottom.

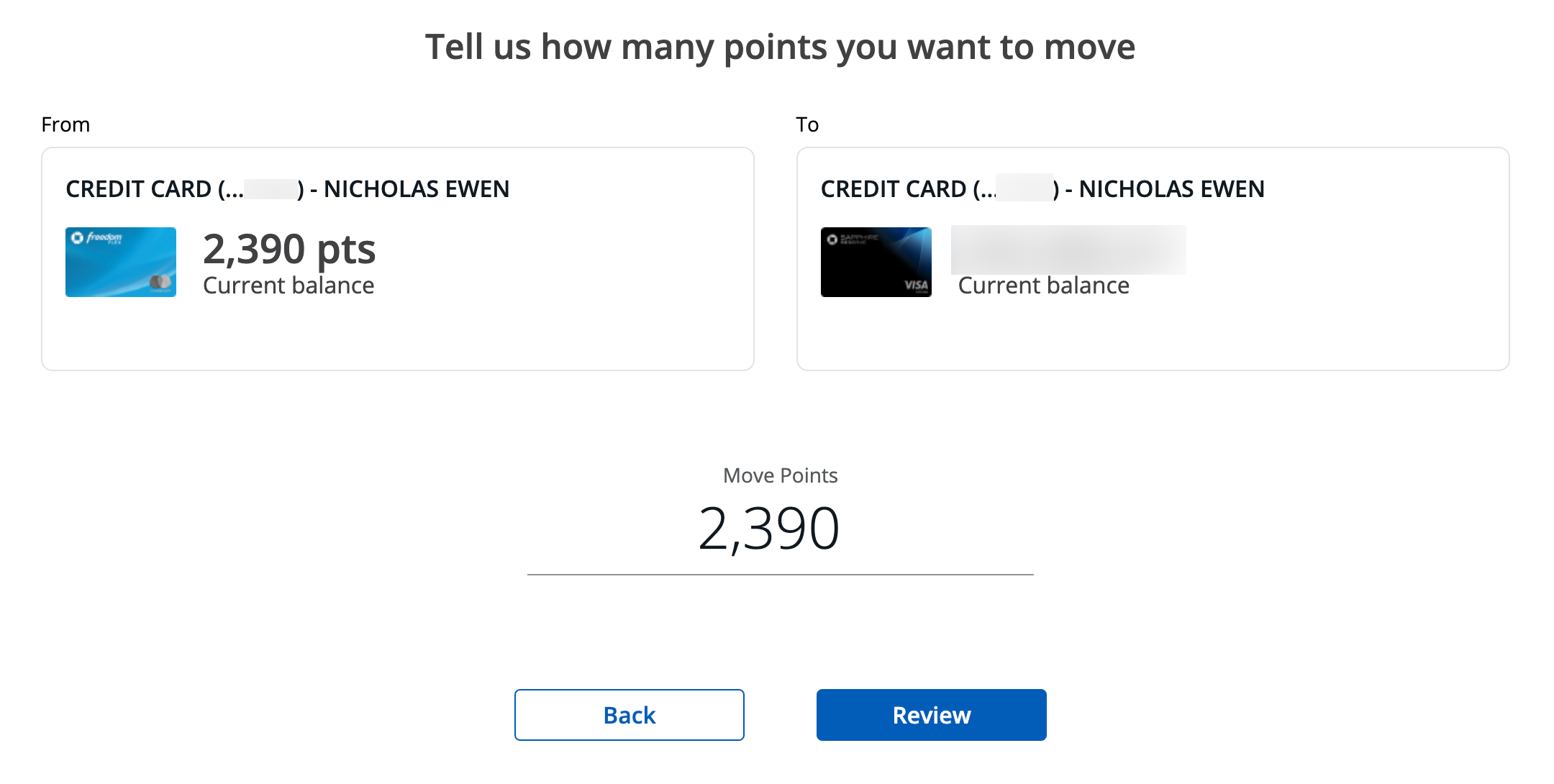

On the next page, you must type in the exact number of points you want to move. Note that, unlike transferring Ultimate Rewards points to travel partners, you don’t have to stick to multiples of 1,000 points. You can move any number of points between your accounts.

When you’re ready, click “Review” at the bottom of the page.

Review the details (including the terms and conditions at the bottom), then click “Submit” when you’re ready to process the transfer.

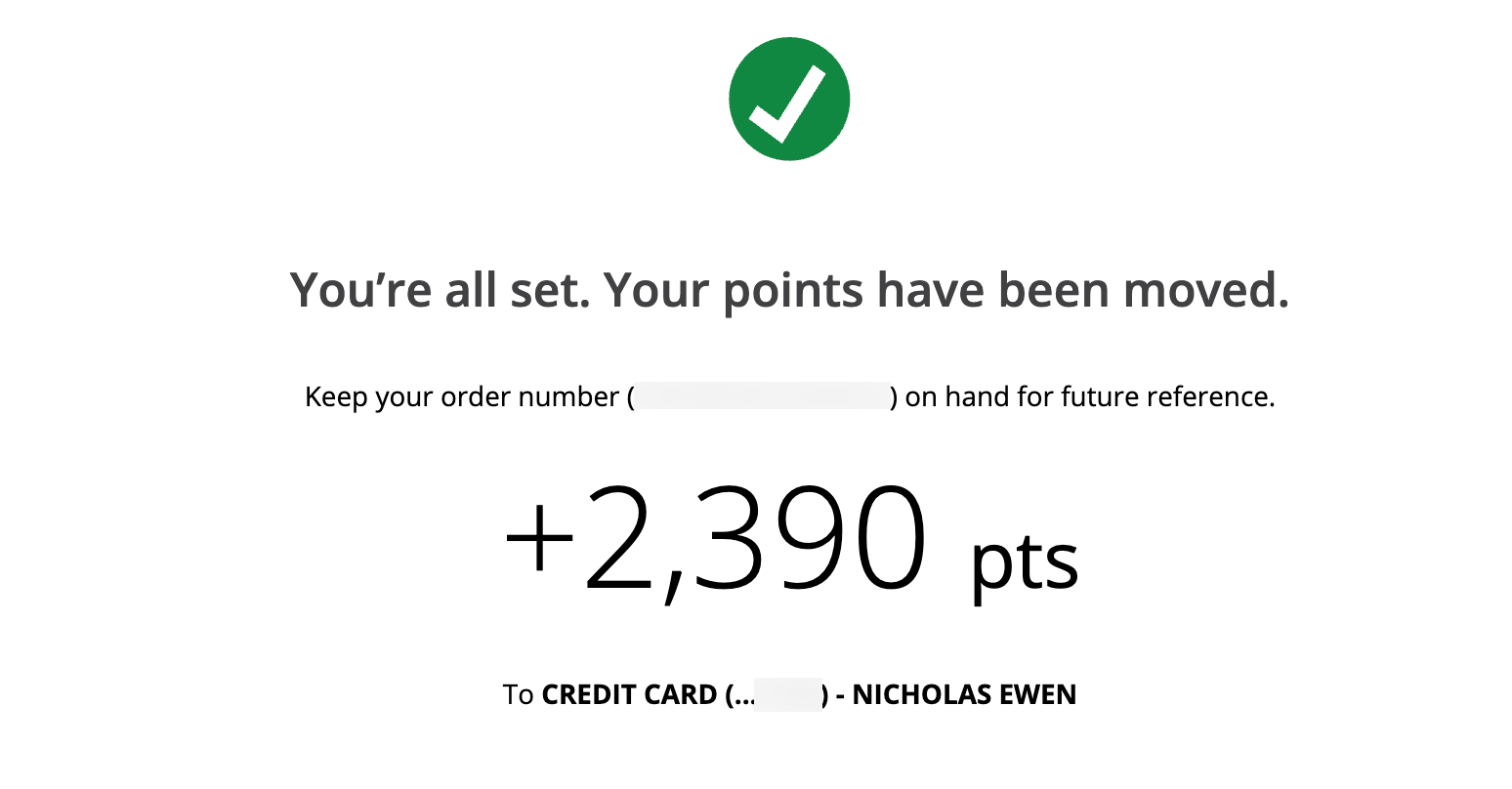

The next page will confirm that the transfer was successful.

Your new balance should also be reflected at the top of the page, as these transfers happen instantaneously.

Related: From international business class to domestic hops: 6 of the best Chase Ultimate Rewards sweet spots

How to transfer Chase points to another person

In addition to combining your points in a single account, you can also use this functionality to transfer points to (or from) another person’s account.

However, before doing so, read the terms and conditions of combining Ultimate Rewards points:

You can move your points, but only to another Chase card with Ultimate Rewards belonging to you, or one member of your household. If we suspect that you’ve engaged in fraudulent activity related to your credit card account or Ultimate Rewards, or that you’ve misused Ultimate Rewards in any way (for example by buying or selling points, moving or transferring points with or to an ineligible third party or account, or repeatedly opening or otherwise maintaining credit card accounts for the sole purpose of generating rewards or manufacturing spend, repeatedly opening or otherwise maintaining credit card accounts for the sole purpose of generating rewards) we may temporarily prohibit you from earning points or using points you’ve already earned. If we believe you’ve engaged in any of these acts, we’ll close your credit card account.

When you transfer points between your own accounts, you’re clearly within the bounds of these terms. However, when you transfer points to someone else’s Ultimate Rewards account, they must be a member of your household (or an owner of the business for Chase Ink cards).

Currently, when you transfer points to another individual’s account for the first time, you’ll need to call the number on the back of your card. Explain to the agent that you’d like to combine your points with a household member. The agent will then ask for the card number of your household member before you can initiate a transfer.

After calling, your household member’s account should appear as an eligible account to transfer points to online. So, you should only need to call once — unless you or your household member decide to remove the account.

Once you’ve added a household member’s account, the process is identical to what I outlined above. You’ll choose how many points to transfer, review the details and then submit the transfer request.

Related: Supercharge your Chase Ultimate Rewards balance with these top 5 cards

When to transfer Ultimate Rewards points between accounts

Now that you know how to combine Ultimate Rewards points into a single account, you may wonder when it makes sense to do so.

Here are three times you’ll want to consider combining Ultimate Rewards points into one account.

Converting cash-back rewards to Ultimate Rewards points

As I discussed earlier, cards like the [applyLink pid=”221211281″ overridetext=”Chase Freedom Unlimited”] are not simply cash-back cards. If you also have a premium card, such as the [applyLink pid=”221211836″ overridetext=”Chase Sapphire Reserve”] or the [applyLink pid=”22125056″ overridetext=”Chase Sapphire Preferred”], you can convert your cash-back rewards into Ultimate Rewards points.

Ultimate Rewards points are the most valuable when redeemed directly for travel, particularly when you transfer to partners like Hyatt and United Airlines.

For example, let’s say you have both the Sapphire Preferred and the Chase Freedom Unlimited. The Freedom Unlimited offers these bonus categories that the Sapphire Preferred does not:

- 3% back on drugstore purchases

- 1.5% back on all non-bonused spending

However, those cash-back rewards can be converted into full Ultimate Rewards points if you also have the Sapphire Preferred. As a result, this is equivalent to earning 3 Ultimate Rewards points per dollar spent at drugstores and 1.5 Ultimate Rewards points per dollar spent on non-bonused spending.

That’s better than using the Sapphire Preferred for these purchases, which would net just 1 point per dollar.

This gets even better with the redemption options. With a cash-back card like the Freedom Unlimited, your rewards are generally worth just 1 cent apiece (though Chase occasionally runs specials for gift cards or even Apple products).

But with the Sapphire Preferred or the [applyLink pid=”221211974″ overridetext=”Ink Business Preferred”], your points can be used to book travel directly through Chase Travel℠.

Through Chase’s Points Boost feature, you’ll receive up to 1.75 cents per point on eligible bookings, depending on the card and the specific redemption (see your rewards program agreement for full details). This jumps to up to 2 cents for the Sapphire Reserve (see your guide to benefits for more information).

But if you want the potential for even more value, combining your rewards with either Sapphire card or the Ink Business Preferred enables you to transfer points to the program’s various travel partners. If you can redeem them for the full amount of TPG’s July 2025 valuations, your value jumps even more.

This is also a great option if your partner or spouse only has cash-back cards with no annual fee, which is precisely the case in my family. My wife has an [applyLink pid=”22125825″ overridetext=”Ink Business Cash”] and a Freedom Unlimited, and we periodically transfer her rewards into my Chase Sapphire Reserve account. I can then use these points for more valuable redemptions than she’d get on her own.

Boosting accounts for a specific redemption

Another reason to combine points is if you have a specific redemption in mind. You can book some outstanding awards with Ultimate Rewards points, but you may not have enough points in your account for the one you want. If your designated household member has some extra points, they could transfer those points to you through Ultimate Rewards so you can book the redemption you want.

When you want to cancel a card

A final rationale for combining points is if you want to cancel a card. Before canceling your card, consider downgrading your card instead.

Before doing so, transfer your rewards to another of your accounts (or to your designated household member). That way, you don’t lose your rewards.

Related: Here’s why you should never close your credit cards before the 1-year mark

Bottom line

The Ultimate Rewards program is incredibly valuable, and much of that value comes from the flexibility of the points you earn. You can transfer to various travel partners, but you can also combine points across your accounts or transfer points to a designated household member.

If you’ve recently signed up for a new Ultimate Rewards-earning card like the [applyLink pid=”22125056″ overridetext=”Chase Sapphire Preferred Card”], I hope this post has given you some insight into how you can extend the value of your points even further.

Related: Chase Sapphire bonus eligibility changes: Here’s what to know

Related Articles

Marvelous in Munich: A review of the Rosewood Munich

[circuit type=review circuit_id=”20420194269″] Editor’s note: The Rosewood Munich provided TPG with a...

What’s new and trending in Ibiza this season

The hotels, beach clubs and party spots to know about on the...

Beyond the Buzzcut: Men’s salons in Dubai that do it all

From sharp fades and beard sculpting to massages, facials, and even braiding...

12 of the best spots to celebrate World Chocolate Day in Dubai

Treat yourself on Dubai’s sugar-laden offerings World Chocolate Day is coming up...

Leave a comment