Futures Frenzy Pushed Crypto Exchange Volume To Nearly $80 Trillion In 2025

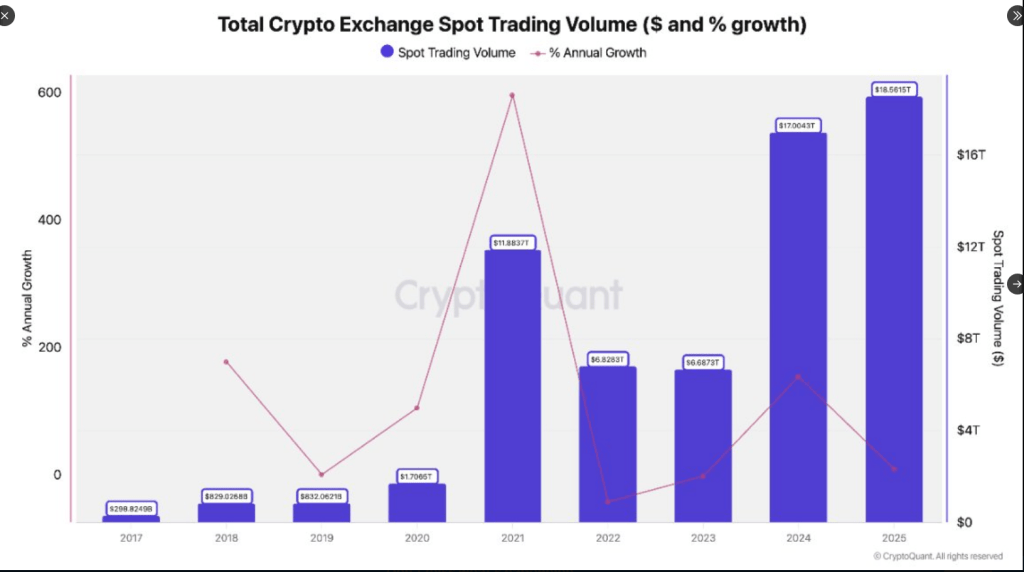

According to reports, global crypto exchange trading volume jumped to over $79 trillion in 2025, driven largely by futures and perpetual contracts. That surge pushed derivatives to claim most of the market’s activity, while spot trading grew at a much slower pace.

Spot Volume Climbs While Futures Explode

Spot trading finished the year near $18.6 trillion, an increase of roughly 9% versus the prior year. But futures and perpetuals were the real story: they totaled close to $62 trillion, making up about 77% of combined exchange volume. That heavy tilt toward derivatives shifted where liquidity and daily turnover were concentrated.

Exchanges At The Center Of Activity

Binance stood out as the top contributor to both segments. Reports show Binance handled roughly $25.4 trillion in Bitcoin perpetual futures alone — about 42% of the top 10 platforms’ Bitcoin perpetual volume — and continued to hold large stablecoin balances relative to peers. Other major venues such as OKX, Bybit and Bitget formed a secondary tier for futures trading.

2025 crypto exchange activity in review.

Spot volume reached $18.6T (+9% YoY) while perpetuals surged to $61.7T (+29%), with Binance dominating spot, BTC perps, liquidity, and reserves.

Growth is derivative-led, and market power continues to concentrate at the top. pic.twitter.com/Om8udJJ9Qv

— CryptoQuant.com (@cryptoquant_com) January 12, 2026

Derivatives Data Variations

Not all trackers measure markets the same way. Some platforms reported even higher figures for derivatives in 2025 — CoinGlass, for example, tallied about $85.7 trillion in crypto derivatives volume for the year. Differences in counting methods, which products are included, and which venues are covered explain much of the gap between sources.

Why Futures Dominated Trading

Traders used futures to take positions, hedge exposures, and respond quickly to price moves. That activity raised daily turnover and boosted the headline totals. While spot trading reflects direct buying and selling of coins, futures multiply notional flow because a single contract can represent a much larger notional value than a spot trade.

The concentration of trading on a handful of platforms has drawn attention from watchdogs in recent years. Regulators have warned that heavy reliance on a small set of exchanges could pose risks if those venues suffer outages or enforcement actions. The data for 2025 renewed those concerns because a large share of the new volume was funneled through the biggest operators.

What This Means Going Forward

Based on reports, the derivatives market’s dominance could continue unless spot demand picks up substantially or regulation alters trading incentives. Institutional interest, products tied to regulated markets, and changes to stablecoin rules are all possible factors that could reshape volumes next year. Analysts caution that headline totals will keep varying with methodology and which datasets are used.

Featured image from Unsplash, chart from TradingView

Related Articles

AI bots are betting billions on the future, but (no one knows if) they’re cheating | Opinion

Autonomous trading AI agents now dominate prediction markets, but the infrastructure to...

Saylor Defends Bitcoin Treasury Firms Amid Rising Criticism

Strategy chairman Michael Saylor pushed back on critics who say companies that...

Bitcoin ETFs turn red after four days of inflows, post $394.68M outflow

Bitcoin ETFs recorded $394.68 million in net outflows on January 16, ending...

Steak ‘n Shake adds $10 million in Bitcoin to its strategic reserve

Steak ‘n Shake’s Bitcoin strategy may inspire other businesses to integrate cryptocurrency,...

Leave a comment