- Home

- Advertise With us

- World News

- Tech

- Entertainment

- Travels & Tours

- Contact US

- About us

- Privacy Policy

Top Insights

Ethereum Outpaces Bitcoin in July Surge as ETF Inflows, BTC Dominance Shift Market Dynamics

After trailing Bitcoin for most of the year, BTC Dominance is falling, and ETH ▲3.99% has surged past expectations with a 44% rally from its July low of $2,373 to over $3,526.

It also helps that news hit this week that former Palantir and PayPal co-founder Peter Thiel bought 9% of an Ethereum Treasury company. The shift in momentum comes as institutional demand heats up and Ethereum ETFs gain steam, putting pressure on Bitcoin’s dominance in the market.

But does this mean the Bitcoin bull run is over? Here’s what you should know:

ETH/BTC Breakout Hints at a Structural Trend Shift

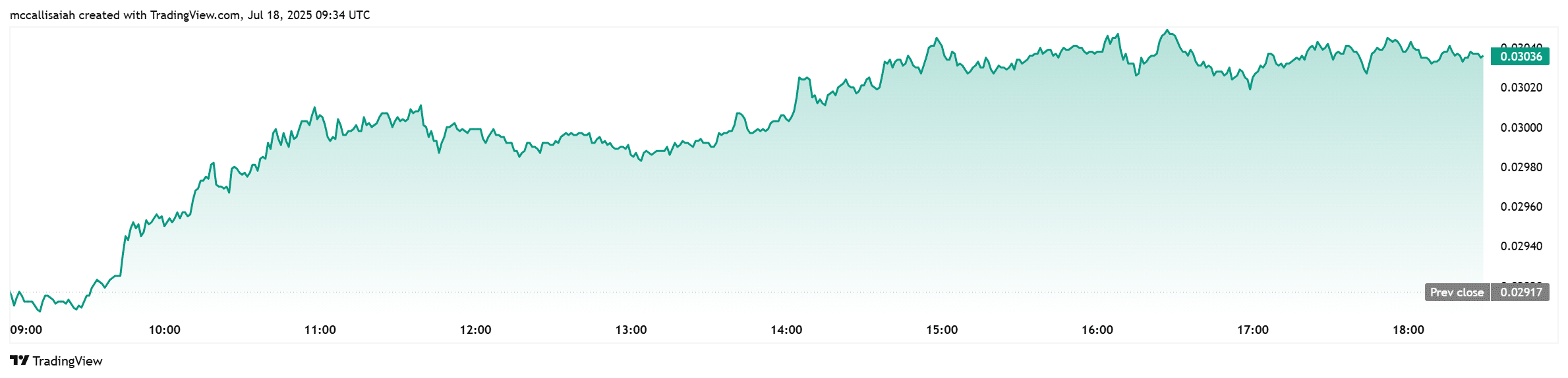

After more than a year of decline, the ETH/BTC ratio is finally showing signs of life. It recently broke through resistance at 0.02629 BTC and is now pressing up against 0.02968, a level that, if cleared, could set the stage for a full-blown uptrend in Ethereum’s valuation relative to Bitcoin.

“If ETH/BTC can maintain its bullish bias, then there is a 99% chance BTC Dominance has topped.” – Matthew Hyland, crypto analyst, via X

After a brutal slide that began in 2023 and worsened through mid-2024, ETH/BTC is showing early signs of life. The rebound off the 0.015–0.020 range hints at a possible long-term trend shift.

But Bitcoin isn’t on the ropes yet. As 99Bitcoins analysts pointed out, BTC dominance (BTC.D) has yet to break its bullish structure. A full ETH/BTC uptrend could take weeks or months to play out, leaving room for BTC to rally.

Bitcoin Dominance Drops, Opening the Door to Altcoin Season

Part of Ethereum’s strength stems from renewed institutional interest. In July alone, Ethereum ETFs posted net inflows of over 79,674 ETH — roughly $256 million — with iShares’ fund accumulating nearly 56,000 ETH ($180M+).

By contrast, Bitcoin ETFs logged higher dollar inflows — about $404 million — but Ethereum’s rate of ETF growth relative to its market cap is noteworthy.

Trump again bought $3,000,000 $ETH.

Ethereum is taking the lead.

pic.twitter.com/WttEZ5w8Tn

— Ted (@TedPillows) July 18, 2025

Bitcoin dominance has dropped over 5.4%, breaking below a key ascending trendline and now sitting at 62.47%.

If the reversal sticks, the next leg of the cycle could tilt toward altcoins with Ethereum leading the charge.

What Comes Next for ETH?

A clean break above the 0.038 BTC resistance would lock in Ethereum’s reversal narrative — and turn institutional eyes squarely on ETH.

In the meantime, ETH continues to benefit from favorable ETF flows, Trump family support, rising investor sentiment, and declining BTC dominance. ETH is about to cook.

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- The clock is ticking on one of crypto’s longest legal dramas, and the XRP price could be ready to rocket.

- All eyes are on Powell this week. As inflation lingers and labor metrics soften.

The post Ethereum Outpaces Bitcoin in July Surge as ETF Inflows, BTC Dominance Shift Market Dynamics appeared first on 99Bitcoins.

Related Articles

Nasdaq-listed MEI Pharma launches $100M Litecoin treasury plan, stock rockets 50%

MEI Pharma’s Litecoin initiative signals growing institutional crypto adoption, potentially boosting Litecoin’s...

Ethereum’s Breakout Above The MA50 Suggests Further Upside, Here’s The Target

Ethereum (ETH) has decisively broken above a resistance level, the 50-day Exponential...

Metaplanet vs. Semler Scientific: The race to become Bitcoin’s biggest corporate whale

Metaplanet and Semler Scientific are turning corporate balance sheets into Bitcoin battlegrounds,...

VET price gains amid staking, Revolut boost

VeChain is eyeing fresh gains as altcoins bounce amid the latest bullish...

Leave a comment