- Home

- Advertise With us

- World News

- Tech

- Entertainment

- Travels & Tours

- Contact US

- About us

- Privacy Policy

Top Insights

Ethereum at Crossroads: $2.2K or $2.7K Next This Week? (ETH Price Analysis)

Ethereum remains dormant below the critical $2.5K resistance, constrained by declining volatility and subdued trading activity. A decisive move in either direction will likely require a fresh injection of demand or supply to break the current equilibrium.

Ethereum Price Analysis: Technicals

By Shayan

The Daily Chart

ETH is currently exhibiting muted trading activity and compressed volatility just below a critical resistance zone at $2,500.

After rebounding strongly from the 0.5–0.618 Fibonacci support band between $2.2K and $2.1K, the price encountered a confluence of technical barriers, namely, the 200-day moving average and the underside of the previously broken wedge pattern.

This confluence has stalled upward momentum, suggesting that market participants are in equilibrium, with neither buyers nor sellers in control.

As a result, ETH is at a critical juncture: if selling pressure intensifies, a rejection from this level could trigger a more significant correction. Conversely, should bulls force a breakout above this resistance, a short squeeze may follow, propelling the price toward the $2.7K mark.

The 4-Hour Chart

On the lower timeframe, ETH remains trapped in a narrow consolidation band, with minimal volatility and directionless movement. The fair value gap between $2.3K and $2.39K has been acting as support, while the resistance aligns with the broken wedge’s lower boundary.

This technical deadlock could soon be resolved, as a breakout from either side is likely to trigger a decisive move.

Notably, the early formation of a head and shoulders pattern at this inflection zone suggests increased probability of a bearish breakdown. Should this pattern confirm, a decline toward the $2K psychological support becomes increasingly plausible.

Sentiment Analysis

By Shayan

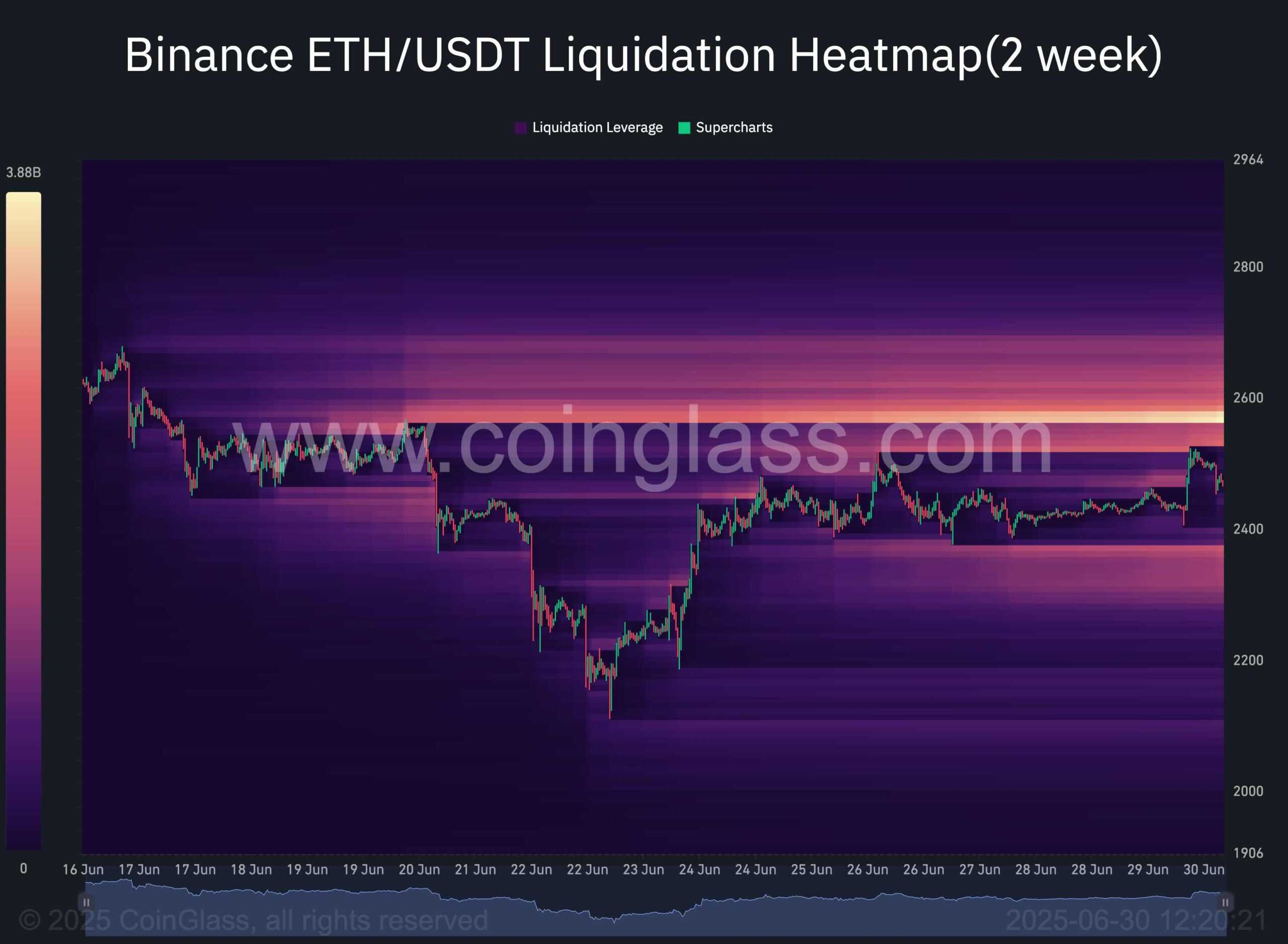

This chart illustrates the Binance Liquidation Heatmap, highlighting areas where significant liquidation events are likely to occur.

High concentrations of potential liquidation levels often act as magnets for price, as large traders, commonly referred to as “whales”, capitalize on these liquidity zones to execute orders efficiently. Once these orders are filled, price direction can swiftly reverse.

Currently, a substantial liquidity cluster is present just above the critical $2.5K level, suggesting the possibility of a price move toward this zone, which could potentially trigger a short squeeze. However, this also underscores persistent selling pressure near the current price, emphasizing the presence of active sellers. As such, the $2.5K level remains a key resistance, and the next decisive move, whether a breakout or rejection, will likely shape Ethereum’s short-term trajectory.

The post Ethereum at Crossroads: $2.2K or $2.7K Next This Week? (ETH Price Analysis) appeared first on CryptoPotato.

Related Articles

BONK approaches critical support: will a Double Bottom launch the next move?

BONK is nearing a critical support zone that could trigger a bullish...

Dow Jones up on strong trade news, Trump’s tax bill

Major U.S. stock indices extended their rally as positive news on trade...

Bitcoin Price At $145,000 In September? Bullish Dojis Suggest Upward Move

Crypto analyst Stockmoney Lizards has provided an update on the current Bitcoin...

Where are we in the Bitcoin cycle? Analyst Lyn Alden shares her view

Analyst Lyn Alden discusses whether Bitcoin has reached the top of the...

Leave a comment