Breaking XRP ETF Update as SEC Deals Fresh Blow to Ripple

TL;DR

- The US Securities and Exchange Commission continues to delay making a decision on various applications for spot XRP ETFs.

- With 15 such filings sitting on the agency’s desk, though, experts are convinced that Ripple will have its own spot exchange-traded fund by the end of the year.

The update from the SEC concerns particularly the Franklin XRP ETF, which was filed for review in March this year. The Commission initially postponed making a decision in April this year, seeking further comments from issuers and potential investors.

It initiated proceedings to determine whether to approve or reject the applications in June. The regulator had 180 days since the initial filing (March) to announce its final decision, and the deadline was September 15.

However, the new delay posted earlier on September 10 informs that the SEC has extended the review period for another 60 days, which means that the new deadline is November 14, 2025. Most other XRP ETF applications have a deadline for October this year.

XRP’s price has remained largely unaffected by the latest setback. The asset climbed to just over $3 earlier today and has remained there in the past hour or so after the SEC news went live.

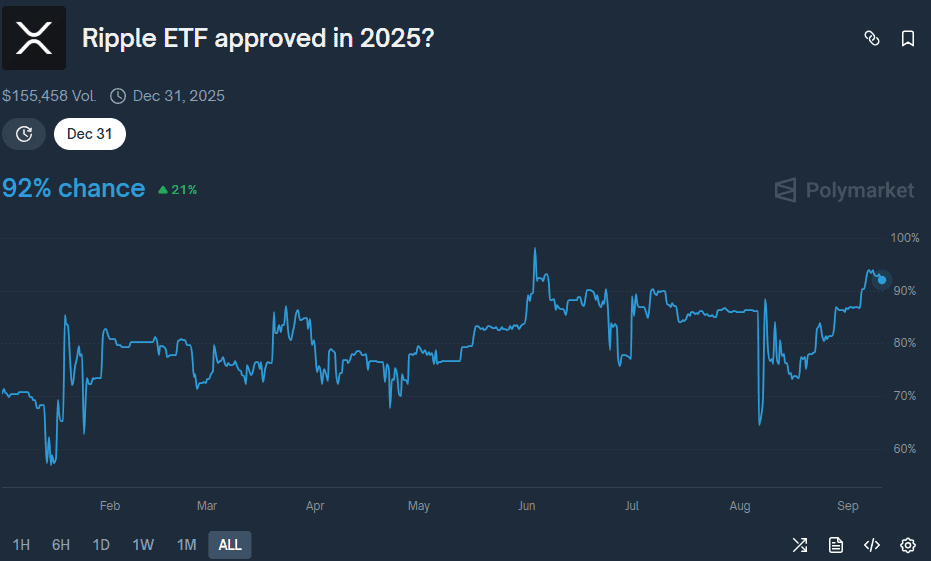

Despite today’s development, Polymarket data still shows that the overall chances for a spot XRP ETF to be approved by the end of the year are north of 90%.

The Commission took a similar approach for another crypto ETF application. The agency delayed making a decision on staking for the world’s largest ETH ETF, BlackRock’s ETHA.

SEC delays decision on staking for BlackRock spot $ETH ETF $ETHA

— The Wolf Of All Streets (@scottmelker) September 10, 2025

The post Breaking XRP ETF Update as SEC Deals Fresh Blow to Ripple appeared first on CryptoPotato.

Related Articles

SEC delays BlackRock, Franklin Templeton crypto ETF decisions

The SEC has extended deadlines for crypto funds tracking Solana and XRP,...

iPhone 17’s New MIE Feature Strengthens Crypto Wallet Security

Cobo founder DiscusFish has said that the new iPhone 17 introduces a...

Toncoin, Quant Seeing Whale Activity Explosion, Big Move Ahead?

Toncoin and Quant are two altcoins that have witnessed a surge in...

Bitcoin Bollinger Bands reach ‘most extreme level,’ hinting at explosion to $300K BTC

A widely used Bitcoin technical analysis indicator suggested that BTC is on...

Leave a comment