Bitcoin Tech Booms: Lightning Data Defies Digital Gold Narrative

Bitcoin Magazine

Bitcoin Tech Booms: Lightning Data Defies Digital Gold Narrative

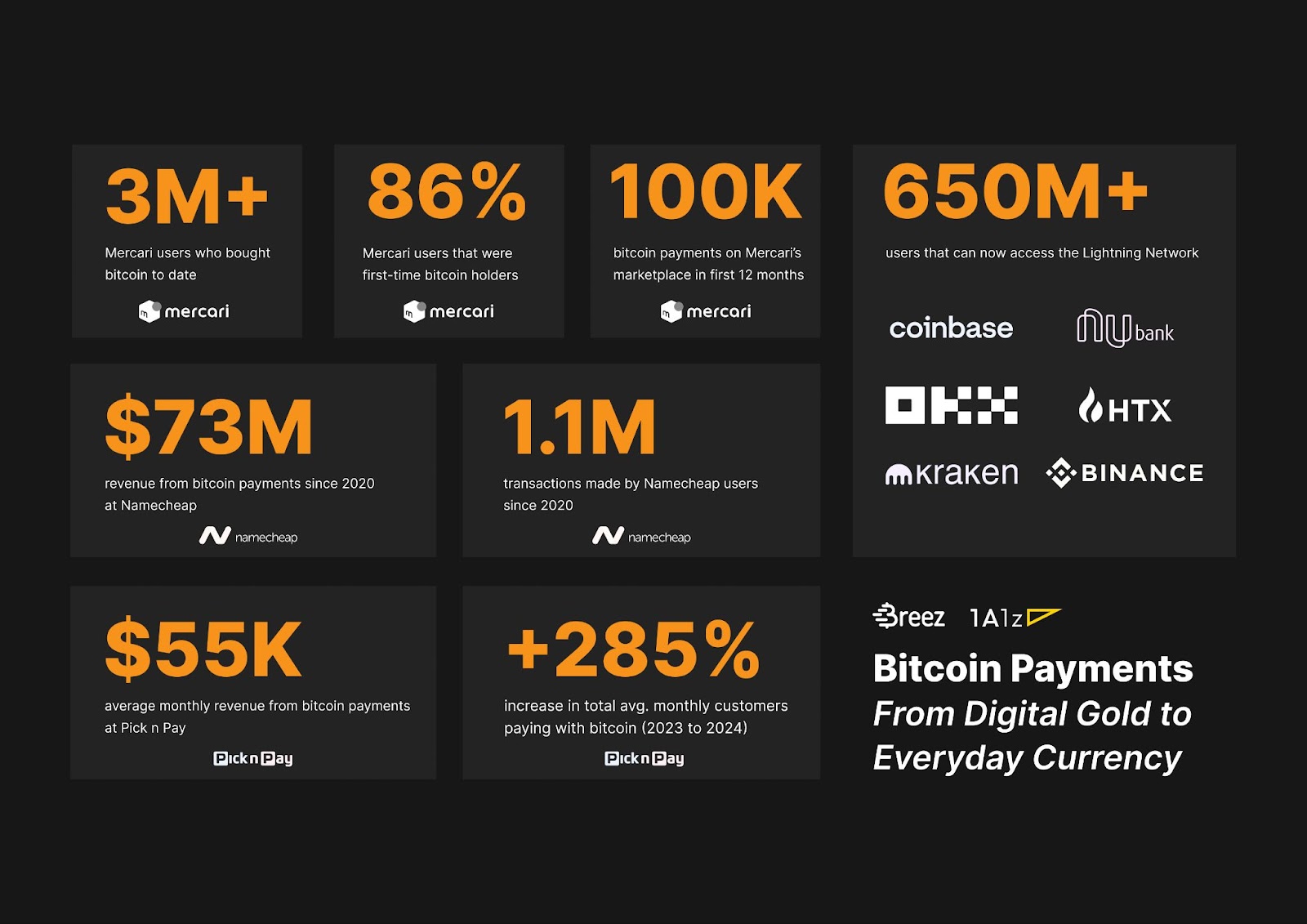

Ego Death Capital’s portfolio reveals adoption metrics including $1.5 billion in Lightning-powered trading volume, as Block shocks the industry with their 9.7% Lightning Network yield.

While bitcoin treasury companies, debates about market structure bills, and strategic bitcoin reserve advocacy dominate the headlines in 2025, a trend is quietly growing in the background: the success of Bitcoin technology companies.

Increasingly recognized as digital gold and a long-term store of value, bitcoin is far more than just a shiny rock in cyberspace. As a software technology, Bitcoin is programmable and has unlocked a new paradigm of payments, custody, settlement and trading possibilities.

Nevertheless, some critics point to the empty blocks on the Bitcoin base layer and historically low transaction fees as implicit proof that Bitcoin is failing as a medium of exchange. Others claim that the Lightning Network has failed to get mainstream adoption and even argue that it suffers from significant privacy problems. But the opposite may be true.

New data coming out of various companies throughout the industry is starting to paint a different picture. Perhaps the Lightning Network has been so successful in drawing transactions off chain and making them more private that it is hard to quantify success metrics without companies involved sharing the data.

But, a variety of Bitcoin start-ups and companies using bitcoin to build out new financial infrastructure are now starting to boast of their success metrics, claiming numbers that suggest there is a strong product market fit beyond treasury strategies.

Jeff Booth, author of The Price Of Tomorrow and co-founder of the Bitcoin-focused VC firm Ego Death Capital, told Bitcoin Magazine he doesn’t “think the general public has any clue with how fast the Bitcoin ecosystem is growing.” Adding that, “They keep on hearing treasury companies this and politics that, and they’re missing the forest for the trees.”

Below follows a summary of various companies and projects demonstrating Bitcoin adoption in significant numbers, many of them within the Ego Death Capital portfolio.

Block: Earning Big on Lightning and Bitcoin Payments

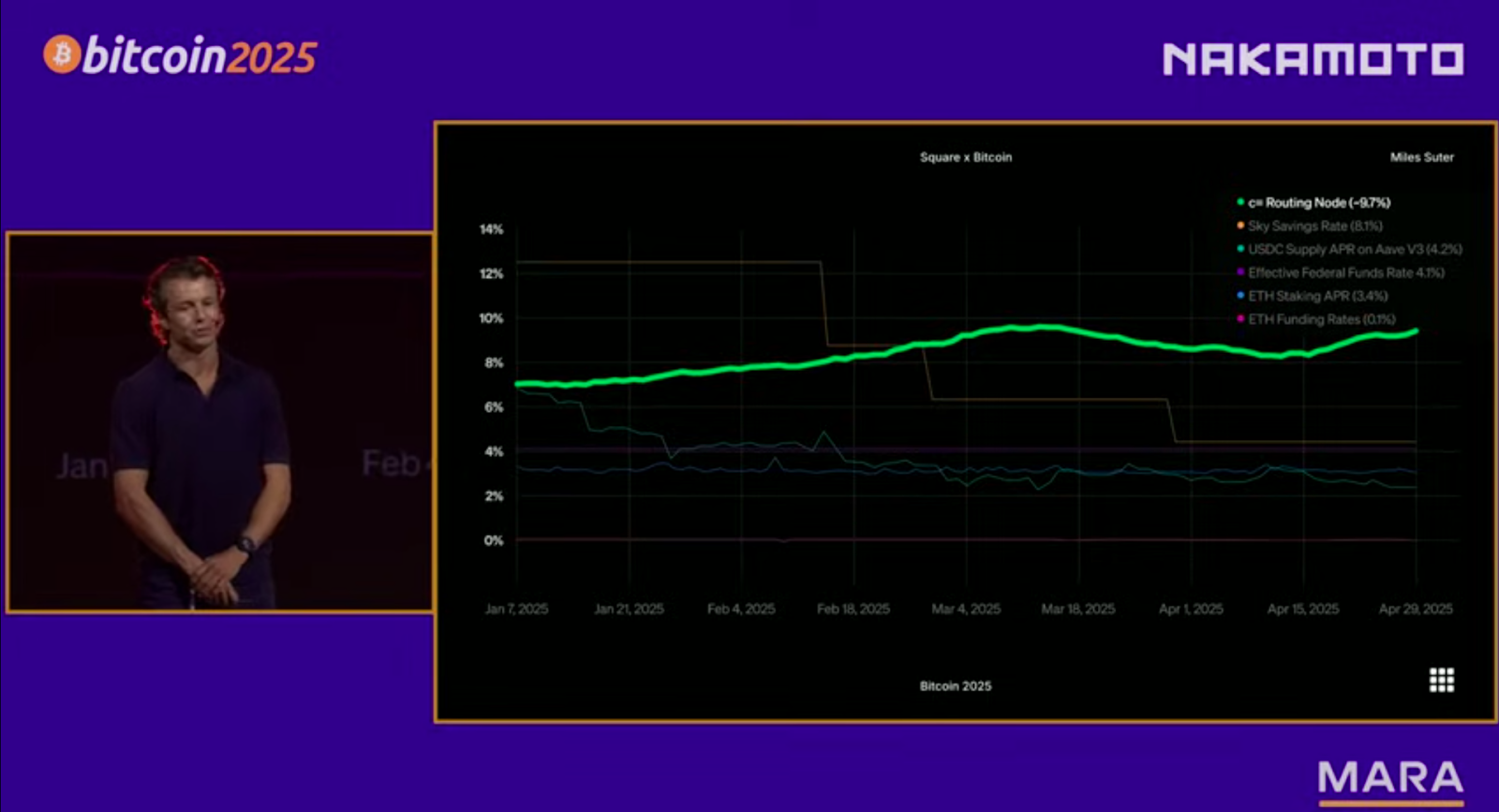

The contrast in perspectives between the digital gold thesis and those that believe in Bitcoin as a payments technology was most recently seen at Bitcoin Vegas 2025 where Block, the parent company of Cash App, disclosed that they are earning 9.7% yield off their Bitcoin Lightning node.

Miles Suter, Bitcoin Product Lead at Block, told the live audience that “at the infrastructure layer, we’re earning nearly 10% bitcoin-on-bitcoin returns by efficiently routing real payments across the Lightning network. This isn’t yield from altcoin staking or reckless speculation; it’s from solving hard, real-time routing problems, and its real bitcoin-on-bitcoin returns from our corporate holdings via supporting real payments use cases.”

Besides Block’s stunning 9.7% figure announcement, which stood out as one of the most lasting impressions from the conference, Suter claimed that Cash App ranks “among the top bitcoin on-ramps in the U.S., accounting for nearly 10% of on-chain block space at any time,” adding that in 2024, its Lightning usage grew 7x and one in four of their outbound Bitcoin payments are processed on Lightning. These numbers highlight Block’s growth as a Bitcoin payments giant, now perhaps the most common merchant payments terminal and consumer payments app that integrates bitcoin.

Ego Death Capital

Ego Death Capital has been investing in Bitcoin infrastructure start-ups since 2022, initially raising a tactical 30 million dollar fund amid a boom in crypto and altcoin VC investments.

“When we first raised money, we actually targeted 30 million because the ecosystem at that time was really early. We realized we had to lean into these companies to help them scale. There were a lot of big crypto funds at that time, but they were spraying money everywhere else. And it was largely the exact opposite of what we believed would happen on Bitcoin.” Booth recalled that “Bitcoin was a protocol. It was developing in layers and it was early. And if you realized that and leaned in to help those companies that were developing in the layers, helping the infrastructure be created, then you would accelerate that. You would accelerate what we saw Bitcoin being, a currency, a store of value, an entirely new network.”

“We don’t have a failure in that fund,” Booth said of the firm’s first investment cohort, which included companies like Breez, Relai, LN Markets, Fedi, Wolf and Simple Proof. “That fund is just over three years old. It’s staggering. A number of those companies, I think three of those companies are already profitable — and profitable in bitcoin terms. So adding bitcoin to their treasury each month and growing incredibly fast.”

Breez: Powering a Global Lightning Payments Network

Breez, founded in 2018, is a self-custodial Lightning-as-a-service provider that enables developers to integrate Bitcoin payments into apps using its open source Breez SDK. By simplifying Lightning’s complexities, Breez has been driving widespread adoption across diverse industries.

“Over 40 apps have already implemented our SDK in production or beta since we launched it less than 18 months ago. Collectively, ~1.5 million users now have access to self-custodial, peer-to-peer bitcoin payments through these apps. These apps processed over $4.5 million in gross transaction volume in 2024,” wrote Roy Sheinfeld, CEO of Breez, in a January 2025 blog post.

The “Bitcoin Payments Report” by Breez and 1A1z, released February 2025, added, “The Lightning Network now reaches over 650 million users; driven by integrations with mainstream products, new developer tools, and growing merchant adoption.” A month later Sheinfeld published that “Lightning Pay’s user base has been growing with users moving a billion sats monthly.” Additionally, Breez’s integration with Klever Wallet brought Lightning to “100,000 monthly active users,” as stated in a December, 2024, blog post.

LN Markets: Lightning-Fueled Trading Takes Off

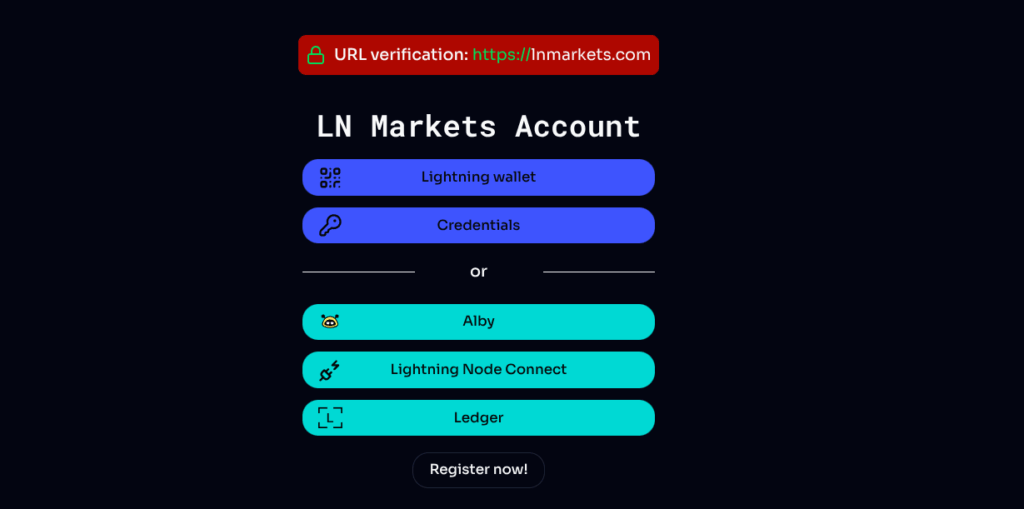

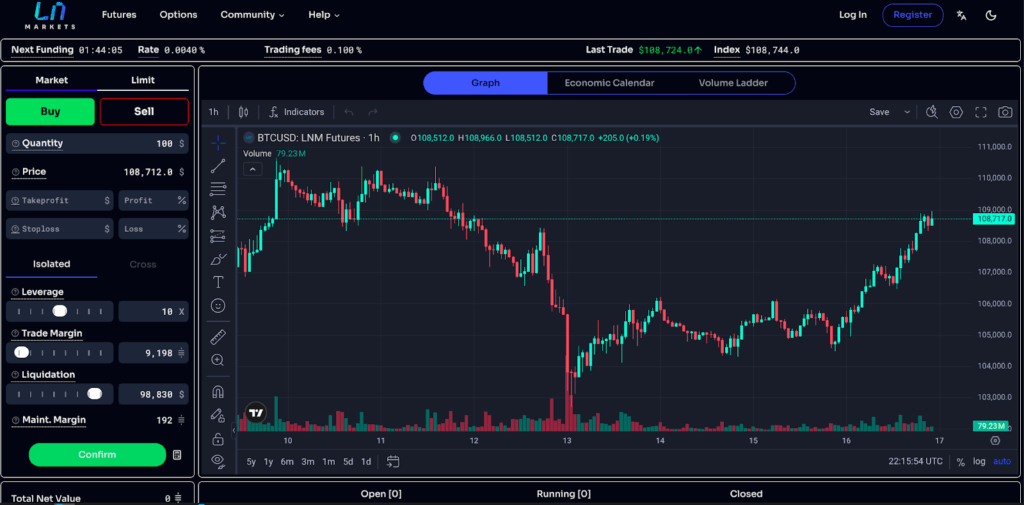

LN Markets, launched in 2020, is a Bitcoin-native derivatives trading platform, leveraging the Lightning Network for instant settlements and minimized counterparty risk.

Its Lightning-native login interface demonstrates they are on the cutting edge of Bitcoin technologies and unlocks user experience features that differentiate it from most other advanced trading platforms. The fast payment rails that result from this deep integration with the Lightning Network unlock faster settlement, lower withdrawal fees and provides access to smaller traders throughout the third world, with many users in South America in countries like Mexico, Brazil and Colombia.

“Basically we’ve gone from 50 million in monthly trading volume to 1.5 billion last month in May,” co-founder Romain Rouphael told Bitcoin Magazine, adding that they have gone from “one billion dollar yearly trading volume in 2023 to six billion last year to 12 billion this year.” Profitability is also strong, with Romain stating, “We double our revenue each year and we double our EBITDA as well every year,” and “We are doing millions of Lightning transactions every year” These figures highlight LN Markets’ strong and active user base as well as Lightning’s scalability.

The exchange focuses on Bitcoin derivatives like a perpetual futures contract and an options platform, traded against a synthetic dollar that when settled is paid out in Bitcoin.

Relai: Europe’s Bitcoin Neobank

Relai, a Swiss-based mobile app founded in 2020, streamlines bitcoin adoption for Europeans with a user-friendly, noncustodial wallet and brokerage service. Targeting newcomers, it emphasizes dollar-cost averaging and self-custody, making bitcoin savings accessible.

Julian Liniger, co-founder of Relai, told Bitcoin Magazine “we are now exactly five years into the market. We started in the summer 2020, today we are roughly 50 full-time employees, we have raised around 20 million U.S. dollars, we have more than 500 thousand app downloads across Europe, and around 150,000 active users.” He added that, “Last year we did around half a billion of trading volume.”

Liniger says they expect to achieve around one billion in trading volume in 2025 and “eight digits” in revenue.

Madeira: A Bitcoin Economy in Action

The Madeira Bitcoin project, launched on the scenic island, seeks to establish a thriving Bitcoin-native economy, drawing inspiration from Bitcoin Beach in El Salvador. Initiated with the support of Jeff Booth and Madeira’s president Miguel Albuquerque, the project has adopted a bottom-up strategy, encouraging merchants to accept Bitcoin via the Lightning Network for fast, low-cost transactions and the related marketing upside. This approach capitalizes on Madeira’s tourism-driven economy, where Bitcoin’s efficiency outshines fiat systems, potentially driving organic growth.

“So, we went on Madeira and when we did the conference – in 2023” Booth recalled of the initiative, “ It took me a year to get 32 companies to accept Bitcoin. We were pretty proud of having 32 companies onboard. Fast forward a year, I think it’s over 250 companies accepting Lightning in Madeira. You can live in a totally full circular economy in Madeira today.” Organizations like FREE Madeira help interested businesses onboard Bitcoin and maintain a BTCMap that while probably incomplete, gives you a sense of the adoption, boasting 150 active Bitcoin merchants in the small European island.

Initiatives like Sovereign Engineering, a Bitcoin centric event for developers and entrepreneurs to upgrade their skill sets and network add to the appeal of the island, putting it on the map for high tech developers and entrepreneurs. The regulatory environment in Madeira also welcomes innovation, as a special economic region within the euro zone, a development which Booth says “it’s wildly exciting.”

This post Bitcoin Tech Booms: Lightning Data Defies Digital Gold Narrative first appeared on Bitcoin Magazine and is written by Juan Galt.

Related Articles

Bitcoin price steady as Fed keeps interest rates stable

Fed maintains interest rates at current levels, despite pressures from the White...

Polygon co-founder Jordi Baylina revives zkEVM tech under new venture, Zisk

Jordi Baylina’s new venture, Zisk, will carry the zkVM torch forward following...

Cathie Wood’s ARK Unloads Almost $100M Circle Shares, Still Bullish on Stablecoin Giant

ARK Invest, led by Cathie Wood, has sold another $44.76 million worth...

Deribit, Crypto.com integrate BlackRock's BUIDL as trading collateral

The move will lower collateral requirements to access leverage for crypto trading...

Leave a comment