- Home

- Advertise With us

- World News

- Tech

- Entertainment

- Travels & Tours

- Contact US

- About us

- Privacy Policy

Top Insights

Bitcoin Price Risks Market Crash After Closing Below Final Weekly Resistance

Crypto analyst Rekt Capital has warned about a potential crash for the Bitcoin price, after the flagship crypto closed below a critical resistance level. The analyst also highlighted the level that BTC needs to reclaim to invalidate this bearish setup.

Bitcoin Price Risks Crash With Weekly Close Below Resistance

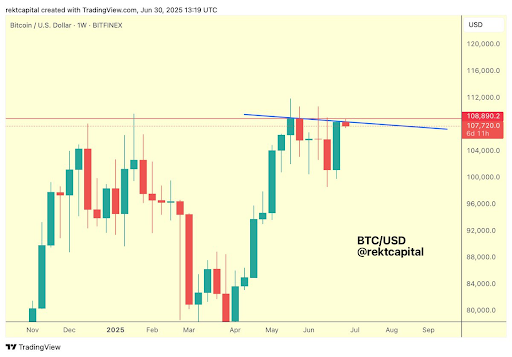

In an X post, Rekt Capital revealed that the Bitcoin price has closed below the final major weekly resistance at around $108,890. Based on this, he remarked that a possible early-stage Lower High resistance may be developing at around $107,720, with BTC at risk of crashing. The analyst added that Bitcoin will need to reclaim $108,890 as support on the daily to invalidate this Lower High.

In an earlier X post, Rekt Capital highlighted how significant it would have been if the Bitcoin price had closed above this final major weekly resistance. He noted that BTC had never performed such a weekly close. As such, if that had happened last week, he claimed it would not only be “historic” but would enable BTC to enjoy a new uptrend into new all-time highs (ATHs).

However, the Bitcoin price now appears to be on a downtrend, having failed to hold above the $107,720 level successfully. BTC had reached an intraday high of $107,970 but has since then been on a decline and is now at risk of losing the $106,800 macro level. Crypto analyst Kevin Capital has warned that BTC being below this level puts it in the danger zone.

Meanwhile, based on historical bull market cycles, Rekt Capital has suggested that the Bitcoin price still has some more upside left. In an X post, he stated that history suggests that Bitcoin may end its bull market in two to three months.

BTC Still Fuel In The Tank

Despite the recent Bitcoin price drop, crypto analyst Titan of Crypto declared that the flagship crypto still has fuel in the tank. He claimed that the weekly market structure remains strong with a series of higher highs and higher lows. The analyst added that the Relative Strength Index (RSI) is pushing towards its trendline.

His accompanying chart showed that the Bitcoin price could still rally to as high as $140,000 between September and November later this year based on these higher highs and lows. Crypto analyst Stockmoney Lizards also recently predicted that BTC could reach as high as $145,000 by September. He alluded to dojis that had formed for the flagship crypto in its current corrective channel and declared they were bullish for Bitcoin.

At the time of writing, the Bitcoin price is trading at around $106,800, down in the last 24 hours, according to data from CoinMarketCap.

Related Articles

Ethena stalls below key level as 40M ENA token unlock approaches

Ethena’s native token ENA is trading at $0.2546 at press time, down...

Bitcoin Holds Key Level Amid $108,000 Rejection, But Analysts Suggest Caution This Quarter

Bitcoin (BTC) attempted to reclaim the $108,000 resistance level again but faced...

SEC approves conversion of Grayscale’s crypto large-cap fund to an ETF

The U.S. Securities and Exchange Commission has approved Grayscale’s request to convert...

XRP Price Retreats From Highs — Is The Rally In Jeopardy?

XRP price started a fresh decline from the $2.320 zone. The price...

Leave a comment