Bitcoin Paces $15 Billion YTD Influx Amid 10-Week Fund Flow Streak

Bitcoin and other crypto funds have kept the cash register flowing for 10 straight weeks, pulling in $1.24 billion in the latest period. That brings the year-to-date haul to $15 billion. Even holiday trading lulls and global jitters haven’t stalled the momentum. Investors seem to be treating this pullback as a chance to buy, not a reason to sell.

Bitcoin And Ethereum Lead The Pack

According to CoinShares data, Bitcoin pulled in $1.114 billion this week alone. It has now logged $2.37 billion month-to-date and $12.7 billion YTD, across nearly $152 billion in assets under management. Ethereum chipped in with its ninth straight week of gains, adding $124 million in weekly inflows.

That pushed its month-to-date total past $1 billion and its YTD figure to $2.43 billion, across $14.29 billion of assets. Investors aren’t scooping up bearish bets, either: short Bitcoin products saw just $1.4 million in outflows this week and $8.7 million since January.

Altcoins See Mixed Results

Solana attracted $2.80 million this week and nearly $3 million month-to-date, lifting its YTD flows to almost $86 million. XRP pulled in $2.70 million weekly and $10.55 million month-to-date, taking its year-long total to $268 million across $1.205 billion in managed assets.

But funds that package multiple tokens bled $5.76 million this week and almost $17 million for the month—though they’re still up $58 million in 2025. Other altcoin vehicles are in rough shape, with $509 million of outflows since January.

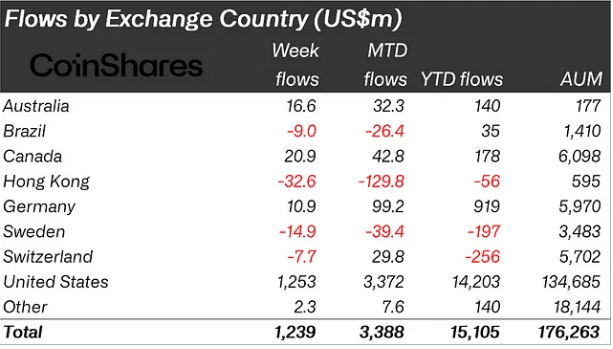

Regional Trends Highlight The US

The United States led global flows with $1.25 billion in weekly inflows. That’s $3.37 billion month-to-date and $14.30 billion YTD, out of $135 billion under management. Canada added nearly $21 million this week and $42.8 million for June.

Germany chipped in almost $11 million while Australia booked $16.6 million. Brazil bucked the trend with $9 million of outflows this week and $26.4 million in June, but it’s still about $34.8 million ahead for the year.

Smaller Tokens Struggle For Attention

Some newer names drew mixed reactions. Sui saw $8.5 million drain this week despite $3.3 million of gains so far in June. Litecoin eked out $0.21 million in weekly inflows and clos to $6 million YTD.

Cardano and Chainlink grabbed $0.34 million and $0.6 million this week, respectively. But smaller “other” products pulled in only $2.75 million against heavy selling since January.

Institutions are still finding reasons to back crypto even as global events and holiday thins slow trading. Total weekly flows hit $1.23 billion, taking June’s total to $3.38 billion and the year’s to $15 billion, across $176 billion in overall assets. Based on these trends, big spenders aren’t ready to abandon digital tokens. They’re treating pullbacks like offers they can’t pass up.

Featured image from Unsplash, chart from TradingView

Related Articles

Who is Arthur Britto, the Ripple ‘ghost’ who just broke 14 years of silence?

Arthur Britto, the elusive co-creator of the XRP Ledger and co-founder of...

Democrats unveil COIN Act to block Trump and public officials from profiting off crypto

Democratic lawmakers have proposed legislation that seeks to block U.S. public officials,...

$4B family office VMS Group to begin investing in crypto: Report

VMS Group is looking to invest up to $10 million with Re7...

Beware: SparkKitty malware wants your seed phrase screenshots

Kaspersky says the malware SparkKitty has been around since at least early...

Leave a comment