- Home

- Advertise With us

- World News

- Tech

- Entertainment

- Travels & Tours

- Contact US

- About us

- Privacy Policy

Top Insights

Bitcoin Investor Sentiment Back To ‘Very Bullish’ — What This Means

The Bitcoin price action was largely sideways rather than strongly bullish for most of June. As of early July, the flagship cryptocurrency has maintained its movements around $108,000 – $110,000 region. While Bitcoin still retains its bullish market structure, recent on-chain data calls for a level of caution when investors are looking for opportunities in the market.

Bitcoin Sentiment Recovers From Bearish

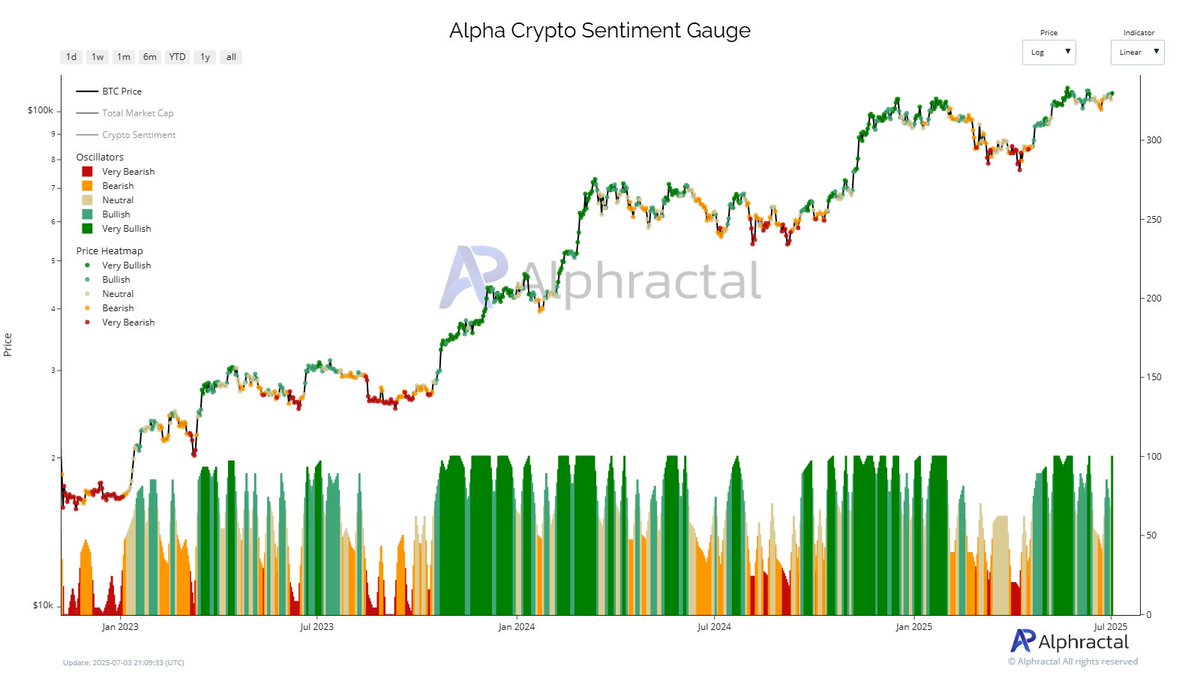

In a July 4 post on the social media platform X, crypto analytics firm Alphractal revealed that the Bitcoin investor sentiment is “very bullish.” This on-chain observation is based on the Alpha Crypto Sentiment Gauge metric.

As its name suggests, the indicator evaluates the emotions of investors in the market, ranging from extreme fear to euphoria. These emotions are represented as color-coded interpretations, usually in red, yellow, light green, and dark green, and these further represent investor sentiment ranging from bearish to very bullish.

In the chart shared by Alphractal above, the appearance of a dark green colour signals that the market sentiment is “very bullish” at the moment.

Prior to their July 4 post, Alphractal reported in a June 23 post that the market sentiment was flashing bearish signals. In the post on X, the analytics firm warned that the bears could be in trouble. Interestingly, the bears were indeed in trouble, as Bitcoin picked up more buying momentum, consequently liquidating several bearish positions.

However, Alphractal explained that sighting green does not necessarily mean the market may be at a top. Instead, it signals that euphoria is taking over the market, which, according to the analytics firm, unlocks a wave of opportunities for Bitcoin buyers.

Alphractal said:

On the other hand, red zones are usually short-lived, but offer exceptional buy opportunities — like no other indicator can.

As the market displayed, the bearish signal interpreted from the Sentiment Gauge eventually provided more buying opportunities. Growing market euphoria is not the only meaning that can be derived from a green signal in the market. It could also serve as a warning for potential overconfidence in the market as Bitcoin continues to gain value.

If history is anything to go by, the market could experience rapid price expansions and an increase in investor risk-on approach. On the other hand, the “very bullish” sentiment could also precede sharp corrections, especially if fueled by crowd emotion, rather than market fundamentals. Whether this green sentiment signals the next price leg up, or the establishment of a market top is yet to be known — as a result, traders are advised to remain alert.

Bitcoin Price At A Glance

After its early show of strength on Thursday, Bitcoin has lost nearly 2% of its value in the past 24 hours. As of this writing, the premier cryptocurrency is valued at about $107,754.

Related Articles

Crypto Market Cap On Track To $4.5 Trillion As Q3 Unfolds – Details

Popular market analyst and key opinion leader (KOL) Ted Pillows is projecting...

BTCC Exchange Reports Remarkable Q2 2025 Performance with $957 Billion Trading Volume

[PRESS RELEASE – VILNIUS, Lithuania, July 4th, 2025] BTCC, one of the...

Ethereum Gains 4% This Week, What are the Next Targets? ETH Price Analysis

Ethereum remains range-bound between the 100-day and 200-day moving averages, signalling a...

Tokenized equity still in regulatory grey zone — Attorneys

The nascent real-world tokenized assets track prices but do not provide investors...

Leave a comment