- Home

- Advertise With us

- World News

- Tech

- Entertainment

- Travels & Tours

- Contact US

- About us

- Privacy Policy

Top Insights

Bitcoin Bounces to $102K but Crypto Market Tensions Remain (Market Watch)

The cryptocurrency market continues to experience heightened volatility, which is evident in the elevated liquidation levels across the derivatives market.

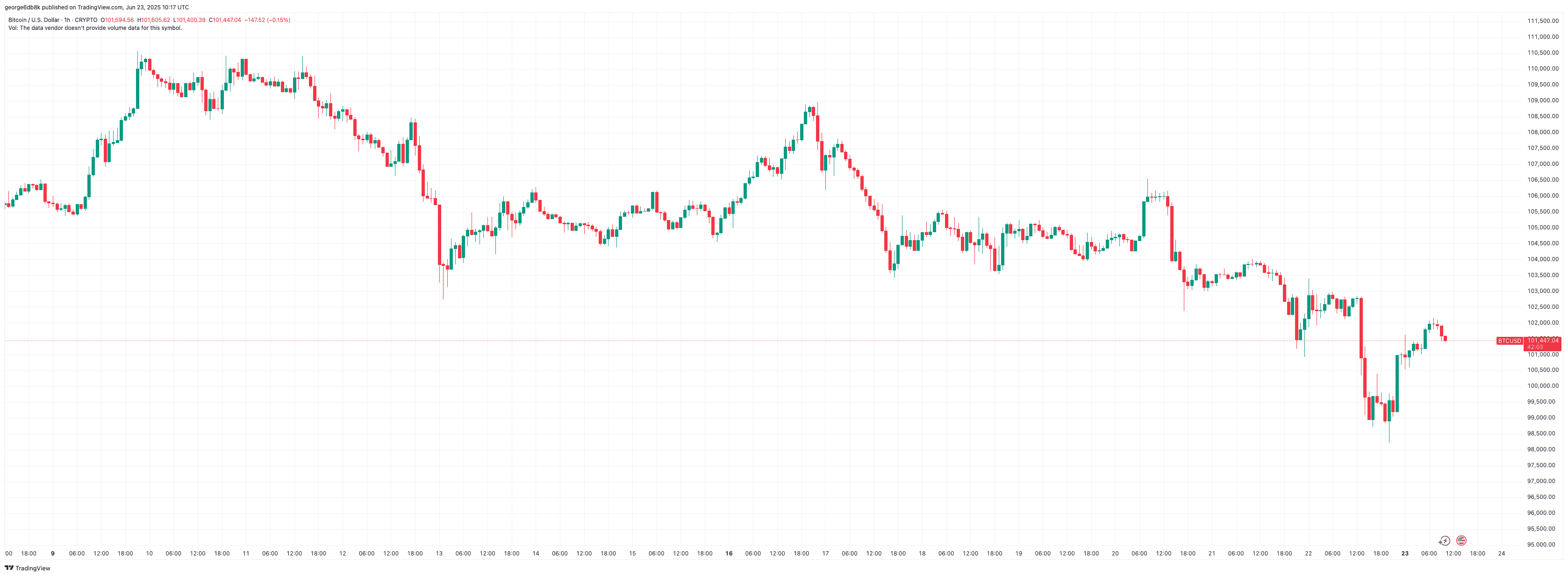

Bitcoin has reclaimed the pivotal $100K mark but the broader situation remains uncertain as the industry remains under the heavy influence of macroeconomic and geopolitical events.

Bitcoin Price Bounces to $102K

As we reported yesterday, the conflict between Israel and Iran escalated. The US joined the war and striked three strategic Irany sites, causing immediate turmoil on international markets with crypto being no exception.

In response, Iran threatened to close the Straits of Hormuz – a critical chokepoint for oil transport, which resulted in even more highly elevated oil prices.

Amid all of this, Bitcoin’s price tumbled below $100,000 for the first time since May and reached an intraday bottom at around $98,000.

The bulls took control, however, and managed ot stage a recovery, with the price currently trading at slightly less than $102,000. The situation remains obviously uncertain, however, and very volatile, which can be seen by the elevated liquidaitons across derivatives markets. Coinglass reports over $600M liquidated in the past 24 hours – that figured surpassed $1 billion yesterday.

Altcoins Remain Shaky

Some altcoins managed to recover better than BTC throughout the same period, while others remain largely in the red. A notable example here is HYPE, which is up by almost 6% in the past 24 hours, where the broader majority of major altcoins are trading either flat or continue losing value against BTC.

Story (IP), alongside Sonic (S), and KAIA are the best-performing cryptocurrencies for the day, up in the range between 7.5% and 10%.

On the other hand, Mantle’s MNT and Bitget Token (BGB) failed to capitalize on the recovery and are down by 3.7% and 2.9%, respectively.

The post Bitcoin Bounces to $102K but Crypto Market Tensions Remain (Market Watch) appeared first on CryptoPotato.

Related Articles

Democratic senator introduces bill to address Trump’s crypto ties

The proposed bill from Senator Adam Schiff followed similar legislation in the...

Hyperliquid DEX token gains 300% in 2 months: Is the HYPE justified?

HYPE is up 300%, and Hyperliquid leads the DEX perp market. But...

In Exactly How Much Trouble is the Ethereum Price Right Now? Analyst Weighs In

Ethereum (ETH) faced renewed downside over the weekend following a US airstrike...

DeFi Development Corp stock to go onchain via Kraken

The company’s CEO described the stock tokenization as a “DeFi Lego block,”...

Leave a comment