- Home

- Advertise With us

- World News

- Tech

- Entertainment

- Travels & Tours

- Contact US

- About us

- Privacy Policy

Top Insights

Bitcoin Bear Case Says Price Is Headed Below $100,000, But Bulls Still Have A Chance, Here’s How

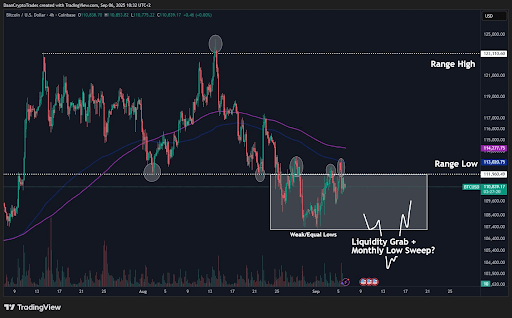

Bitcoin’s price has spent the past week hovering within a tight band and bouncing between $108,000 and $112,000 without any clear direction yet. There have been multiple rejections at the $112,000 price level and technical analysis shows pressure around the 200-day moving averages on the four-hour chart.

Notably, a technical analysis shared by crypto analyst Daan Crypto shows Bitcoin is at risk of a breakdown below $100,000, but bulls still have a chance to stage a recovery rally in the weeks ahead.

Analyst Warns About Sweep Of Monthly Lows

In his latest post on the social media platform X, Daan Crypto Trades noted that Bitcoin is currently indecisive, and its price action is leaning toward a sweep of the monthly lows. This movement is based on the 4-hour candlestick timeframe chart, which shows the Bitcoin price was recently rejected at the 200MA/EMA last week.

The 4-hour candlestick chart below shows Bitcoin has been trading in a defined range since August 25, with equal lows forming a weak base around $107,000 and liquidity sitting just beneath. This makes a stop-hunt sweep a possible next step.

Such a move, the analyst explained, would likely open up a bearish case of panic across the market, which might eventually cause fears of Bitcoin collapsing under the $100,000 price level.

However, the analyst also identified the $103,000 to $105,000 price zone as the support level where buyers can step in. This area, according to him, would also be a logical entry point for swing long positions if the Bitcoin price indeed breaks down below $107,000.

Conditions For A Bullish Recovery

According to the analysis, Bitcoin bulls have a chance to prevent any breakdown below $100,000 by holding above $105,000 to $103,000. Despite laying out a bearish base case, Daan also described a roadmap for the bulls.

The first condition would be strength above $115,000, which would mark a break of August’s range low, which has turned into resistance in the first week of August. A break and close above $115,000 would invalidate any short-term bearish momentum.

Alternatively, he pointed to a quick liquidity grab below the monthly lows at $107,000, followed by a reclaim of the $107,000 and $112,000 levels, as the most bullish scenario. According to the analyst, this second setup could pave the way for a sustained one-to-two-month uptrend rally through October and November.

For now, the analyst said he is on the sidelines except for short-term scalps. At the time of writing, Bitcoin is trading at $111,733, up 0.7% in the past 24 hours.

Related Articles

RLUSD Yes, XRP No: Why Is This Ripple Partner Choosing Only the Stablecoin?

TL;DR One of the first companies aiming to build an XRP strategic...

Is Paper Bitcoin Behind the Stagnant Bitcoin Price?

Bitcoin Magazine Is Paper Bitcoin Behind the Stagnant Bitcoin Price? The bitcoin...

Could A Dogecoin ETF Be Launched This Week? This Expert Thinks So

The cryptocurrency market is closely watching Dogecoin this week as Nate Geraci,...

How to turn crypto news into trade signals using Grok 4

Grok 4 can help you turn crypto headlines into market moves. It...

Leave a comment