BNB Confirms Breakout: Is $1,000 the Next Inevitable Target After ATH?

TL;DR

- BNB confirms a weekly breakout, with support holding and price pushing toward the $1,000 mark.

- Open interest climbs to 1.15M coins, while funding remains low — bullish structure holds strong.

- Technical charts show momentum remains intact, though overbought signals hint at a possible short pause.

Weekly Breakout Clears Long-Term Resistance

Binance Coin (BNB) has moved above a downward channel that had been in place since late 2024. After spending several months inside that range, the recent price action shows a clear move higher. The weekly chart now shows steady gains, with buyers in control over the last few sessions.

Notably, the breakout was smoothly followed by a retest of the $600–$700 zone, which had acted as resistance before. Now, it is holding as support. The asset later climbed above the prior highs of $962. This move confirms the breakout and lets traders focus on the next price levels. A short-term target between the prices has been mentioned as $1,000 and $1,082 by Rose Premium Signals.

#BNB Weekly Breakout: Major Momentum Unleashed

After months of accumulation inside a falling channel, Binance Coin just confirmed a bullish breakout with strong follow-through

Retest held

Continuation in progress

Targets in focus:

$893.85

$1,000.61

$1,082.74… pic.twitter.com/3qCUKp5P4e— Rose Premium Signals (@VipRoseTr) September 16, 2025

BNB was trading near $950 at press time, recording a 3% gain in the past 24 hours and 8% over the last week. Since June, the price has continued a steady upward movement and has set a clear pattern of higher highs and higher lows. Tracing this trend will see BNB hit its essential $1,000 level.

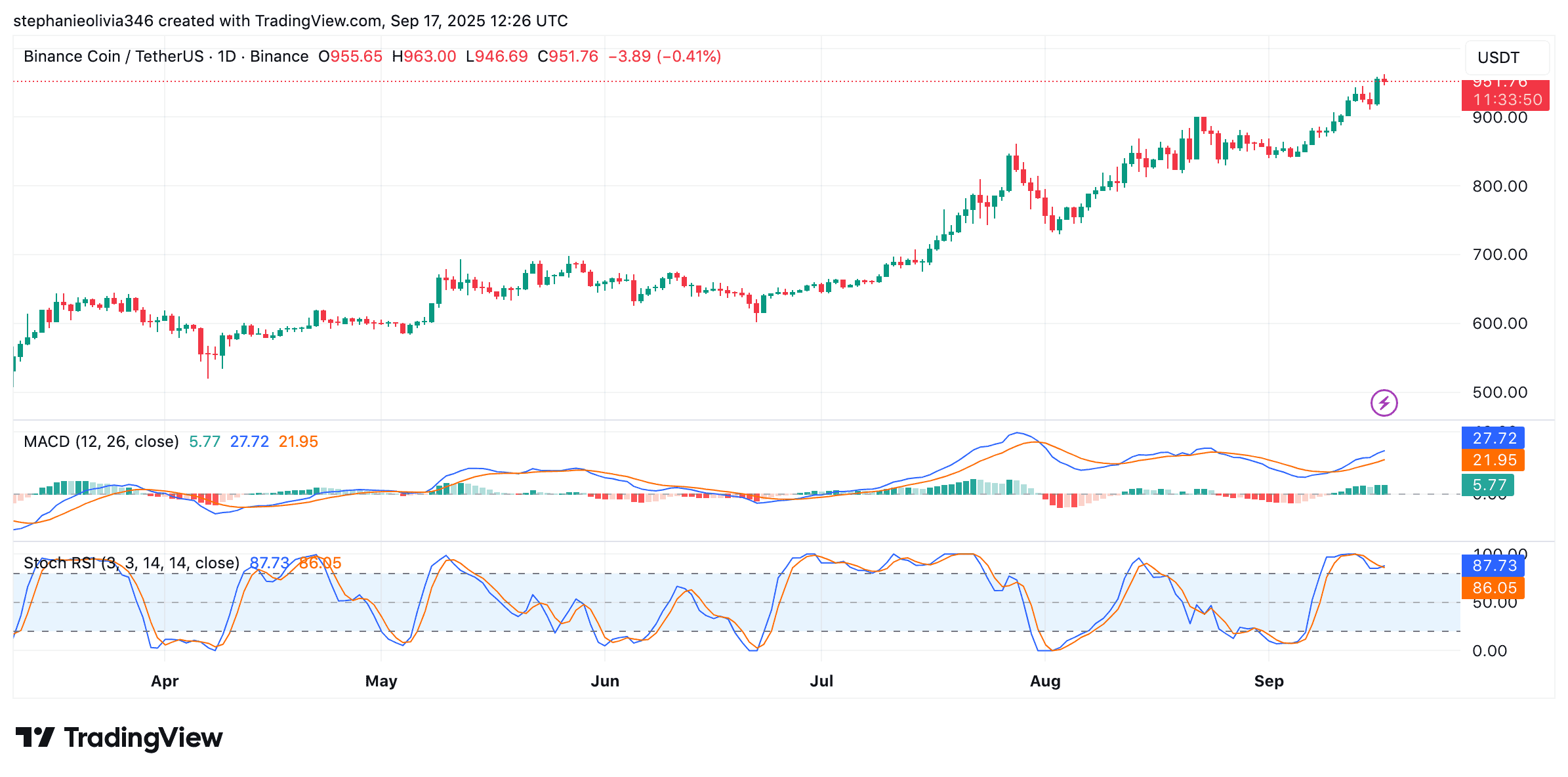

In addition, technical signals on the daily chart support this move. The MACD shows the MACD line above the signal line and the zero line, pointing to strong momentum. The histogram is green, with no immediate signs of weakness. The Stochastic RSI is above 80, placing it in overbought territory, which may indicate a brief pause or sideways movement in the near term.

Open Interest Climbs as Funding Remains Low

Futures data shows open interest (OI) is now around 1.15 million coins. The steady rise in OI reflects growing interest and positioning in BNB’s derivatives market. This is common in trending markets, especially during breakouts. However, it can also increase risk if positions become crowded.

Meanwhile, the funding rate remains low at 0.0058. This suggests long positions are not being heavily financed with leverage, which can often lead to sharp corrections. A lower funding rate also means that traders are not paying high costs to maintain long positions. One market watcher, Saint Pump, noted,

$BNB is the best looking highcap.

I expect the market to roll over by week’s end, but it looks good for a push to ~$1k.

OI is very high, but funding has spiked down, which supports my thinking that there’s room to go up. pic.twitter.com/FBIhr02Cw2

— Saint Pump (@Saint_Pump) September 16, 2025

Regulatory Update

Recent movement may be tied to news that Binance is nearing the end of its compliance monitoring period with the US Department of Justice. The monitoring was related to past enforcement actions involving anti-money laundering and compliance controls. If complete, the exit from that phase would ease pressure on the exchange.

The ex-CEO Changpeng Zhao (CZ) recently updated some links on his X profile related to Binance, and this has led to some speculations that he was considering an active return to the company. However, nothing has been made official so far.

The post BNB Confirms Breakout: Is $1,000 the Next Inevitable Target After ATH? appeared first on CryptoPotato.

Related Articles

SEC approves generic listing standards for faster crypto ETF approvals

The US Securities and Exchange Commission has approved standards that could speed...

Fed Rate Cut Boosts Bitcoin Price Ahead of Q4 Melt-Up

Bitcoin Magazine Fed Rate Cut Boosts Bitcoin Price Ahead of Q4 Melt-Up...

BitGo wins BaFIN nod to offer regulated crypto trading in Europe

BitGo’s move creates further competition in a burgeoning European crypto market that...

Bitcoin Has Taken Gold’s Role In Today’s World, Eric Trump Says

Eric Trump on Tuesday described Bitcoin as a “modern-day gold,” calling it...

Continuation in progress

Continuation in progress

Leave a comment