- Home

- Advertise With us

- World News

- Tech

- Entertainment

- Travels & Tours

- Contact US

- About us

- Privacy Policy

Top Insights

Dogecoin May Pause Above $0.27 Before Charging Toward $0.45 – Analyst

Dogecoin jumped back into the spotlight on Monday after fresh price calls from market commentators and a clear technical move on charts.

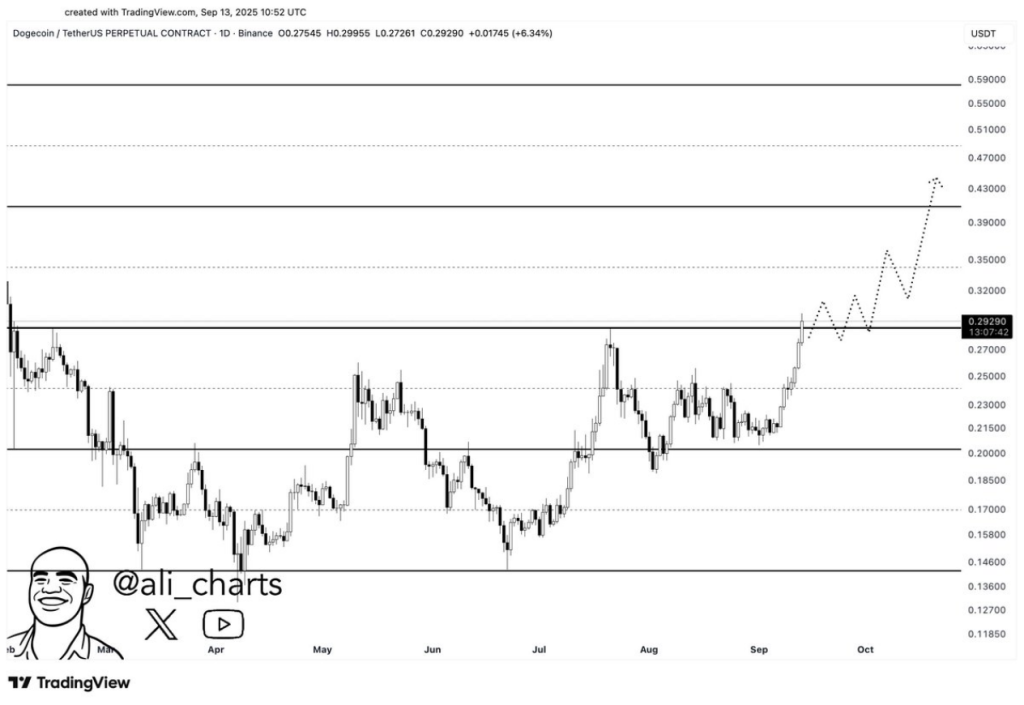

According to Ali Martinez, the meme token could head as high as $0.45, a level last seen at the end of 2021. DOGE was trading at around $0.29, more than 5% higher than it was yesterday, and traders are watching whether now-support at $0.27 holds.

Technical Breakout And Volume Spike

Trading activity around the breakout caught attention. Based on reports, DOGE pushed above the $0.27 zone that had capped rallies through the summer and then consolidated above it, a pattern traders view as healthy.

Dogecoin $DOGE may consolidate for a bit, then expect the next leg up toward $0.45! pic.twitter.com/uynq9IF4wd

— Ali (@ali_charts) September 14, 2025

The weekly chart showed a breakout from a multimonth symmetrical triangle, and trading volumes during that move more than tripled — a sign that momentum gained backing from buyers. Shorter term targets being watched include $0.39 and the $0.43–$0.45 band cited by some analysts.

Triangle Target Paints A Bigger Picture

Chart-based targets diverge. Using the triangle’s maximum height, some calculations put a breakout objective near $0.60, which would be about a 95% rise from current levels if reached by October.

$DOGE breakout

Symmetrical triangle resolved upwards!

Price rising after breakout, eyeing $0.45 target!

Is meme season back? pic.twitter.com/rptobViUoO

— Crypto King (@CryptoKing4Ever) September 13, 2025

Other chartists have lower targets clustered around $0.45, matching the upper line of a wider multi-year triangle. These different readings mean the path higher is not universally agreed, but the technical case for a move is clear on several timeframes.

Short-Term Risks And Support Levels

The key risk is holding the new floor. Reports note that past Dogecoin rallies stalled when gains could not be kept above freshly conquered levels. If DOGE falls back under $0.27, momentum would likely fade and price could slide toward the prior base around $0.20–$0.25.

Retail Demand And Recent Gains

Retail interest has returned, helped in part by the launch of a new Dogecoin ETF, which drew fresh attention to the token. DOGE has already rallied by nearly 40% over the past seven days, outpacing the broader crypto market that rose by about 8% over the same span.

Trading desks say the bias is tilted higher for now, but many traders are treating September as a make-or-break month for the next major move.

Chart Targets Diverge But Bias Is Up

Meanwhile, as momentum indicators and volume favor further upside, cautious traders point to the mixed targets and the need for clear support.

Some models project $0.45 as the immediate ceiling; others place a loftier objective near $0.60. If the breakout is sustained, gains could be swift. If not, losses could be sharp.

Featured image from Unsplash, chart from TradingView

Related Articles

Weekly Close Above $114K Boosts Bitcoin’s Bullish Case

TL;DR Bitcoin tests $118K resistance, with $114K support key to confirming the...

Bitcoin Price Slides Below $115,000 As Strategy Buys Additional Bitcoin

Bitcoin Magazine Bitcoin Price Slides Below $115,000 As Strategy Buys Additional Bitcoin...

CoreWeave signs $6.3B cloud capacity deal with NVIDIA

This deal underscores the escalating demand for AI-driven cloud solutions, potentially reshaping...

Ethereum Foundation’s PSE Rebrands & Emphasizes End-to-End Privacy – Best Wallet Enhances Crypto User Control

The Ethereum Foundation’s Privacy and Scaling Explorations team has rebranded as Privacy...

Leave a comment