Dogecoin Social Surge: Rising Buzz And Network Use Spark New Interest

Dogecoin’s price action caught traders’ attention this week. After dipping toward the $0.13–$0.15 demand zone, the meme‑coin shot higher, and a surge in derivatives data suggests many expect more gains.

Trader Interest Climbs Around $0.19 Resistance

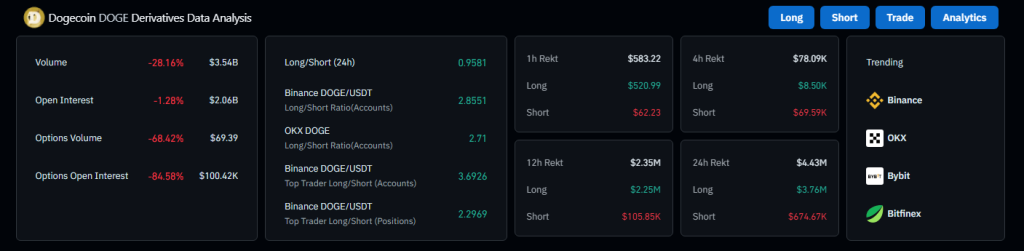

According to market data, Open Interest jumped by 16% to reach over $2 billion. Options volume exploded by 400%. That kind of rise often points to big bets on upward swings.

Right now, many eyes are on the $0.20 resistance level. If DOGE can close a daily candle above that line, it may clear the way toward $0.27.

Dogecoin’s technical setup is drawing fresh looks from chart watchers. The Stochastic RSI crossed above 80, which can mark an overbought zone.

Yet coins have stayed above overbought readings before when buyers kept pushing. Traders will want to see real volume behind any move above that descending trendline near $0.19. Without it, the rally may stall or give back gains.

Whales Return With Spot Inflows

Based on reports, Dogecoin saw a net inflow of $8.20 million into spot wallets. That marks a big shift after weeks of outflows. Large holders have been moving coins onto exchanges in the past, but now they’re pulling more in. In other cycles, fresh whale buys have lined up with mid‑term rallies.

On‑chain metrics add another layer. Dogecoin’s MVRV Z‑score climbed back to 0.355 after hitting near‑historical lows late in June. That figure measures how much profit holders stand to make on average.

A rising score hints that fewer holders are underwater, and that might draw in new buyers. Still, MVRV is backward‑looking. It can’t predict if price will break through key resistance.

Network Activity Shows Mixed Signals

Network stats tell a mixed story. Daily active addresses slid to 34 K, and transaction counts dropped to 15K as of July 3. That’s a sharp fall from the more than 500K addresses and transactions seen in the last week of June. Lower usage could sap the rally’s legs if retail traders don’t reengage soon.

Even with these mixed signals, the mood toward Dogecoin is brighter than it was a week ago. Traders piling into options and hikes in Open Interest show speculative appetite is up.

Large spot inflows show that whales have stepped back in. But network usage is lagging. If daily addresses and transactions don’t bounce back, bulls may find it harder to sustain the push.

Featured image from Meta, chart from TradingView

Related Articles

Analyst Shares Bitcoin Cheat Sheet Showing When The Bull Run Begins

Bitcoin has held steady around the $108,000 price level in recent days....

DEX Trading Volumes Explode – Are CEXes Losing Their Grip on Crypto?

In June, total crypto market capitalization posted a modest 2.62% gain, even...

Drake mentions Bitcoin in new song 'What Did I Miss?'

References to Bitcoin in songs, movies, and televised media indicate that the...

Ethereum loses to rival Solana in dApp revenue: Will SOL rally to $200 in July?

Solana, Ethereum’s largest rival, leads among cryptos with highest dApp revenue. In...

Leave a comment