- Home

- Advertise With us

- World News

- Tech

- Entertainment

- Travels & Tours

- Contact US

- About us

- Privacy Policy

Top Insights

Stablecoins Approach $250 Billion, Anchoring 8% Of Global Crypto

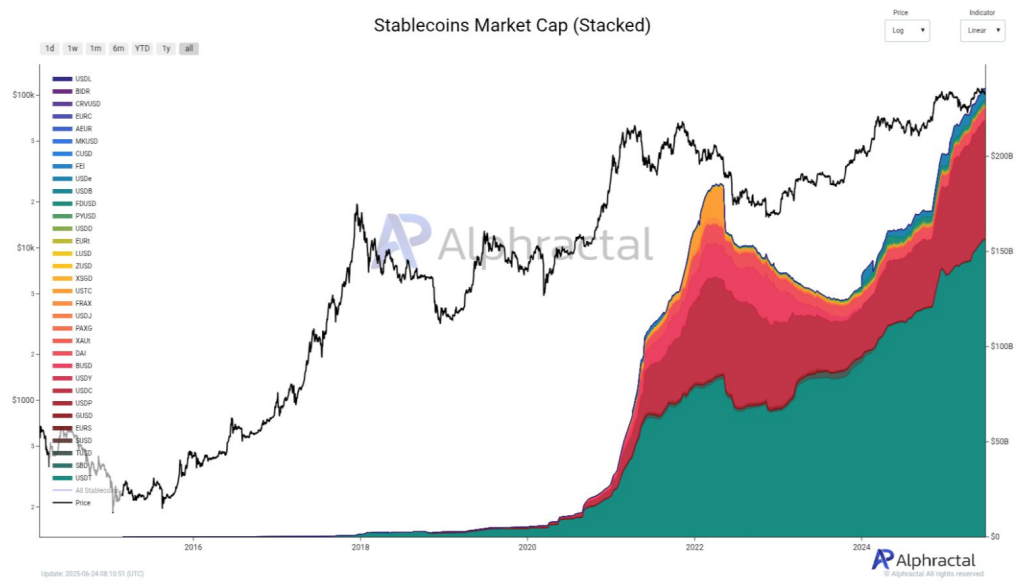

Based on reports, stablecoin issuance has kept climbing for the past 90 days, with billions of dollars flowing in each week. Investors appear to be waiting for a clear sign before moving capital.

Right now, USDT holds over 66% of that market, while USDC and DAI share the rest. In total, stablecoins account for about $250 billion, or almost 8% of all crypto assets.

Stablecoin Supply Hitting New Highs

Demand for a trusted dollar peg is driving this growth. Tether leads by a wide margin because many traders trust its stability. Stablecoin reserves have swelled, even as other segments stay quiet. This points to plenty of cash on the sidelines.

Billions in Stablecoins are issued weekly, and the 90-day change for all Stablecoins shows a large amount of liquidity available in the market.

Tether (USDT) stands out, representing 66.2% of the entire Stablecoin market.

Currently, the Stablecoin market cap is close to $250B… pic.twitter.com/DugpqDiEPl

— Alphractal (@Alphractal) June 24, 2025

Bitcoin And Stablecoin Dominance

Bitcoin and stablecoins together make up roughly 74% of the total crypto market. That’s a big number. In past cycles, once those balances peak, money often moves into smaller tokens. Right now, Bitcoin’s price is steadying after recent swings. Stablecoin balances keep growing.

I can’t promise anything, but there’s a strong chance that a powerful Altcoin Season will take hold in the third quarter of 2025.

I had already mentioned this in some posts before, about June and July, and I still stand by that analysis.

The main reasons are the large amount of… https://t.co/TjRyxBxSKs

— Joao Wedson (@joao_wedson) June 24, 2025

Altcoin Season On The Horizon

Based on forecasts from analyst Joao Wedson, altcoins could see a lift in Q3 2025. He points to the huge amount of stablecoin liquidity and persistent doubt among retail and big players. That stage of doubt has come before in other cycles, and it usually marks a turning point. When confidence returns, altcoins tend to surge.

Investors Poised On The Sidelines

Many holders seem ready to hit buy. They’re holding onto stablecoins until charts, on-chain data or macro news clear up. A boost in stablecoin flows to exchanges could be one early hint that rotation is starting. Large moves by whale wallets into low-cap tokens may follow.

In recent weeks, inflows of stablecoins into trading platforms have ticked higher. That’s a key signal to watch. If weekly inflows rise sharply—say above $5 billion—it may show serious appetite building. Past cycles saw similar spikes just before altcoin rallies began.

Another one to monitor is decentralized finance platform volume. When stablecoins move from wallets to lending or liquidity pools, it usually indicates that traders are looking for return and preparing to swap to other tokens.

Related Reading: Bitcoin Paces $15 Billion YTD Influx Amid 10-Week Fund Flow Streak

Market observers will also be monitoring Bitcoin’s consolidation range closely. If it remains above recent lows for a few weeks, that would give confidence a boost everywhere. Then we could see smaller cryptocurrencies move higher on new liquidity.

Based on these signals, it looks like we’re in a waiting game. Stablecoin supplies are at record levels, Bitcoin is settling, and altcoin sentiment remains low. When all that lines up just right, funds are likely to rotate. Then the altcoin sector could see new life.

Featured image from Imagen, chart from TradingView

Related Articles

Dow Jones up 300 points as weak labor market fuels rate cuts bets

Stocks are up as weak labor market may force the Fed to...

5 coins under $10 that might pump big if BTC soars to $150,000

Bitcoin’s path to $150k in 2025 could ignite a 20x rally in...

Private credit powers $24B tokenization market, Ethereum still dominates — RedStone

The tokenized RWA market is now valued at $24 billion, dominated by...

US Treasury may release federal Bitcoin holdings report, says Bo Hines

The potential release of the US Bitcoin holdings report could enhance transparency,...

Billions in Stablecoins are issued weekly, and the 90-day change for all Stablecoins shows a large amount of liquidity available in the market.

Billions in Stablecoins are issued weekly, and the 90-day change for all Stablecoins shows a large amount of liquidity available in the market.

Leave a comment