- Home

- Advertise With us

- World News

- Tech

- Entertainment

- Travels & Tours

- Contact US

- About us

- Privacy Policy

Top Insights

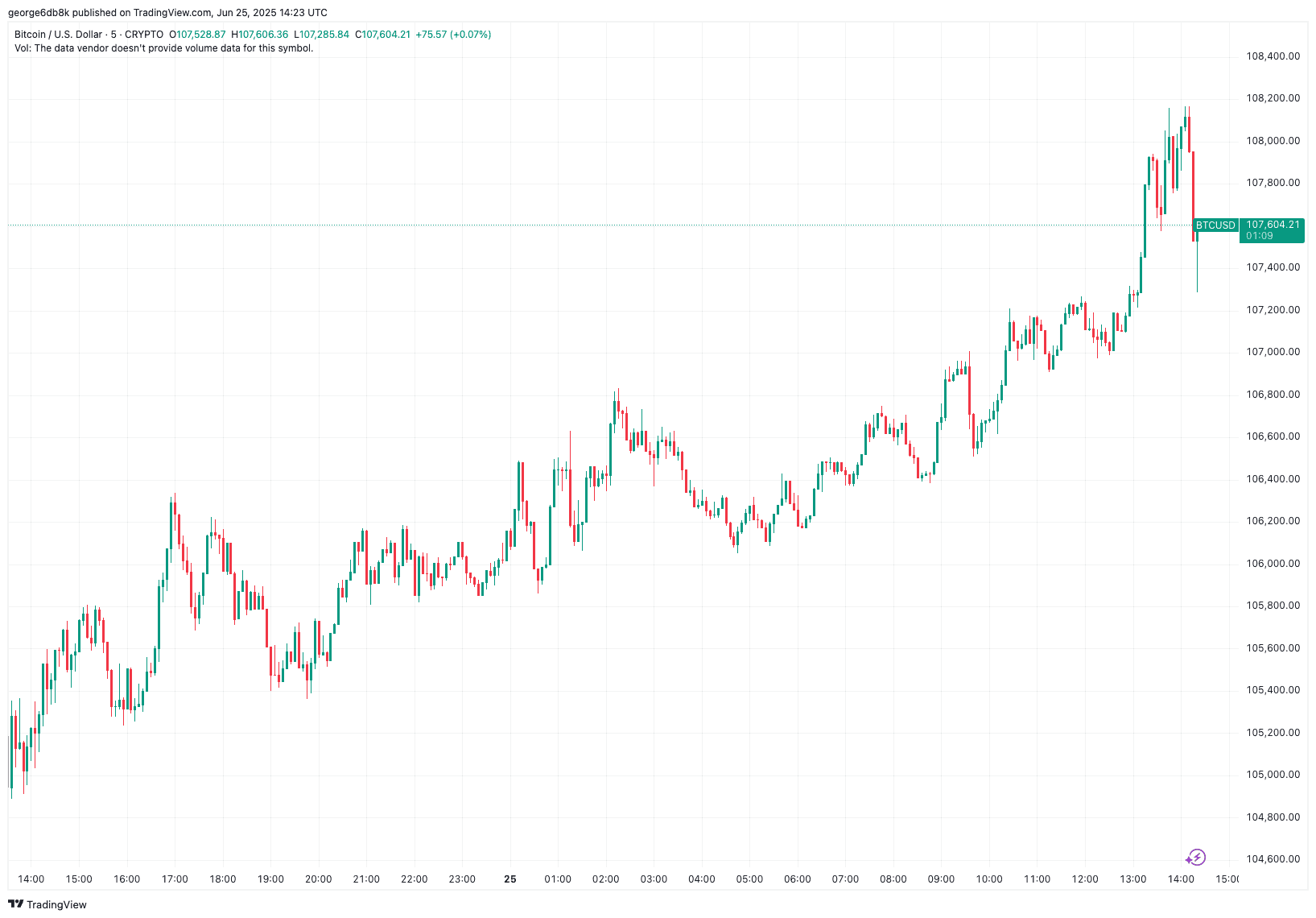

Bitcoin Price Taps $108,000 as Donald Trump Addresses Iran-Israel Situation

Bitcoin’s price has increased by 2.8% throughout the past 24 hours and briefly touched $108,000. The move has caused around $210 million worth of liquidated long and short positions across the derivatives markets, according to data from CoinGlass.

The cryptocurrency has since retraced and currently trades at around $107,600.

The recent price action comes amid several statements made by the US President Donald Trump, who said that he thinks the war between Iran and Israel is over and that “Iran has a huge advantage, I don’t see them getting back involved in nuclear.”

Morever, Trump also spoke of Russia and the situation in Ukraine. He said that they didn’t discuss a ceasefire with President Zelensky, while also saying that he considers Russian President Putin to be “misguided.”

Furthermore, he also outlined that he will be talking with Iranian leadership next week and that they “may sign an agreeme and would ask for no nuclear.”

The market remains very volatile, at the time of this writing.

The post Bitcoin Price Taps $108,000 as Donald Trump Addresses Iran-Israel Situation appeared first on CryptoPotato.

Related Articles

Bitcoin To Surge To $130,000 Next? What The Wave Count Says

After a week of volatile price action, Bitcoin has once again returned...

Is Bitcoin’s (BTC) About to Blow Up to $120K Breakout? What Does Data Show?

Bitcoin briefly dropped below $100,000 during the 12-day conflict involving Israeli and...

Invesco Galaxy files for Solana ETF, 9 issuers now in the race

Invesco and Galaxy Digital have filed the initial documents to launch a...

ETH ETF flows impress, but Ether futures data suggest traders exercise caution

Analysts are bullish on ETH’s long-term prospects and ETF inflows, but futures...

Leave a comment