USDT Supply on Tron Soars Past $80B Amid Growing Adoption

The total circulating supply of USDT on the Tron blockchain (TRC-20) has surpassed $80 billion, according to the latest data from CryptoQuant.

This figure marks a major milestone for the network as it reflects its growing dominance in the stablecoin market.

Tron’s $80B USDT Milestone

Since late 2020, Tron has experienced parabolic growth in USDT issuance, with notable spikes during bull markets. In 2021, supply jumped from $6.71 billion to $39.41 billion. This accounts for an increase of nearly 488%.

The upward trend continued into 2025, as it rose from $59.76 billion at the start of the year to $80.76 billion as of mid-year. On November 13, 2024, Tron overtook Ethereum in total USDT circulation for the first time in three years, which highlighted user preference for its lower fees and faster transaction speeds.

Importantly, Tron’s USDT growth has not been limited to bullish periods. During the relatively stagnant 2022-2023 cycle, the supply on the network still climbed steadily, amidst steady demand and adoption.

Tron-Powered $2B Tether Mint

The latest development comes just two days after the Tether Treasury minted $2 billion USDT on the Tron blockchain, in what appears to be the largest issuance in recent months. This was executed solely on Tron, which highlighted the blockchain’s role as Tether’s preferred network for large-scale liquidity operations due to its speed, scalability, and negligible transaction costs.

The event was swiftly followed by a sharp uptick in stablecoin inflows to centralized exchanges. Interestingly, HTX Global received a net inflow of $1.24 billion in stablecoins within hours. CryptoQuant explained that such inflows often precede increased spot and derivatives activity, particularly in bullish market setups where traders seek to capitalize on short-term price movements or prepare for breakouts.

Zooming out, the timing and scale of this mint suggest a strategic effort to prepare the market for upward price action. For Bitcoin, the influx of stablecoin liquidity translates into greater buying power. As traders respond to improved exchange liquidity, Bitcoin could see upward price pressure fueled by the fresh capital deployment.

The post USDT Supply on Tron Soars Past $80B Amid Growing Adoption appeared first on CryptoPotato.

Related Articles

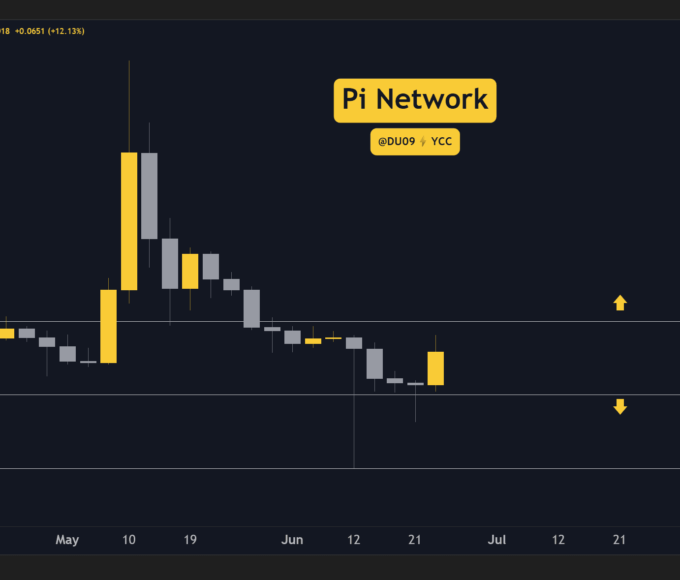

Pi Network (PI) Price Predictions for This Week

Pi Network found support and bounced hard. PI Coin Price Predictions to...

US Bitcoin ETFs record 11 consecutive days of net inflows despite macro jitters

U.S. spot Bitcoin exchange-traded funds neared a two-week inflow streak on Tuesday,...

From Chaos to Composability: Enso’s Connor Howe on Rethinking Web3 Infrastructure

Few startup journeys begin with a vampire attack, but for Connor Howe,...

Pudgy Penguins pops at NASDAQ with VanEck as market watches for PENGU price breakout

Pudgy Penguins’ Nasdaq spotlight has ignited fresh bullish momentum in PENGU price,...

Leave a comment