- Home

- Advertise With us

- World News

- Tech

- Entertainment

- Travels & Tours

- Contact US

- About us

- Privacy Policy

Top Insights

Bitcoin Price Deviates From Global M2 Money Supply, Is The Bull Run Over?

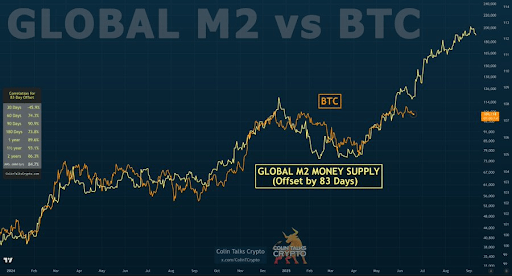

Crypto analyst Colin has highlighted the Bitcoin price’s deviation from the Global M2 money supply, raising concerns that the bull run may be over. The analyst quickly addressed concerns, noting how such deviations usually happen at some point but don’t invalidate the macro trend.

Analyst Highlights Bitcoin Price’s Deviation From Global M2 Money Supply

In an X post, Colin revealed that the Bitcoin price has deviated from the global M2 money supply. He noted that this deviation was short-term in an otherwise broad correlation. The analyst added that this current deviation is similar to the position that BTC was in February 2025.

Colin remarked that this development doesn’t mean the M2 is broken, just as it wasn’t broken back in February. Instead, he claimed that it just means that market participants haven’t zoomed out enough and are allowing for the non-correlated periods. The analyst added that non-correlation between the Bitcoin price and global M2 money supply happens 20% of the time.

He then alluded to the regular chart, which shows the strong correlation between the Bitcoin price and the global M2 money supply. Colin explained that the M2 is “directionally predictive” for BTC and that it is not 1:1 price-related. The analyst further remarked that the M2 does not predict a specific BTC price.

Instead, the global M2 money supply only predicts the market direction, with about 80% accuracy. Colin added that the Bitcoin price has its y-axis while the M2 is on a different y-axis. He also opined that the M2 may decouple from BTC near the cycle top. Although the analyst didn’t provide a timeline for when the cycle top will be, his analysis indicates that the cycle top is not yet in and the bull run isn’t over.

Money Supply Shows No Need To Worry About BTC Price

In an X post, market expert Raoul Pal suggested that the Bitcoin price’s correlation with the money supply shows that there is no need to worry about the current price action. He remarked that if 89% of BTC’s price action is explained by global liquidity, then by definition, almost all “news” and “narrative” is noise.

This suggests that the current geopolitical risks, heightened by the Israel-Iran conflict, are unlikely to impact the Bitcoin price as much as expected. Trading firm QCP Capital recently noted that the flagship crypto has yet to show full-blown panic, which shows how much the asset has matured.

The firm remarked that BTC’s resilient price action appears underpinned by continued institutional accumulation, with companies like Strategy and Metaplanet buying the dip. The Bitcoin ETFs also continue to record positive flows.

At the time of writing, the Bitcoin price is trading at around $104,700, down in the last 24 hours, according to data from CoinMarketCap.

Related Articles

Bitcoin in a post-Trump world worries hedge fund execs: Eric Semler

Eric Semler says he enjoys being the “lone voice crying in the...

Analyst Warns Of XRP Trap — „You’re Being Played”

CryptoInsightUK’s latest market briefing arrives with the sound of literal hammer blows...

Bitcoin futures premium falls to 3-month low despite strong BTC ETF inflows

Bitcoin derivatives traders turned cautious, despite steady inflows to the spot BTC...

Bitcoin’s Dominance Could Kill Altseason Dreams, Analyst Warns

According to an analyst on X, Bitcoin’s grip on the market looks...

Leave a comment