Is Ethereum (ETH) The Most Obvious Trade in 2025?

TL;DR

- ETH is the subject of multiple optimistic predictions, with some well-known analysts forecasting a rise to a new ATH soon.

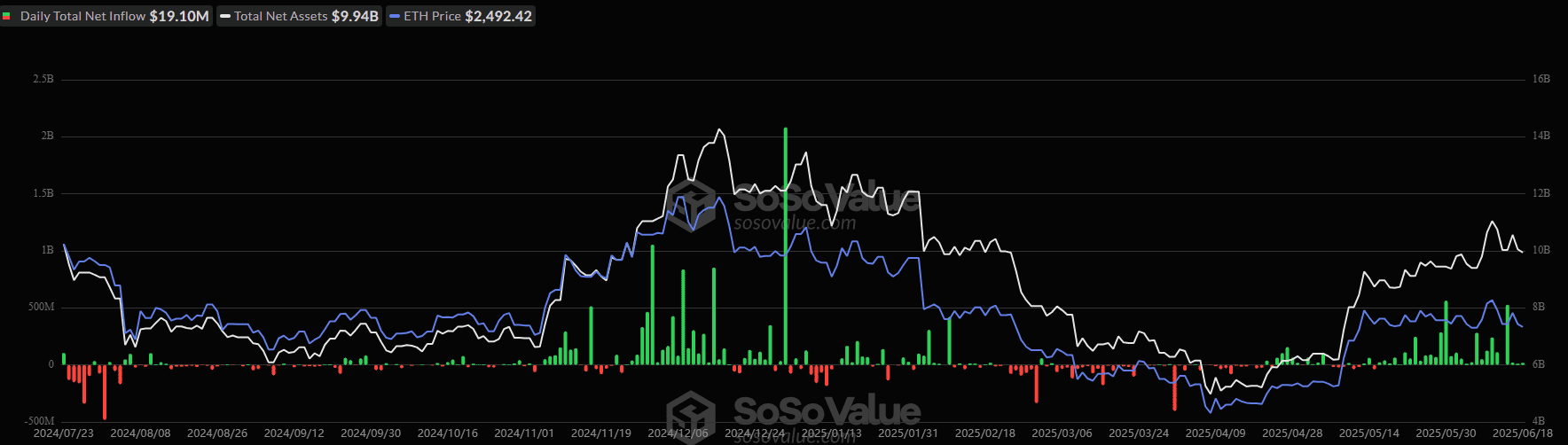

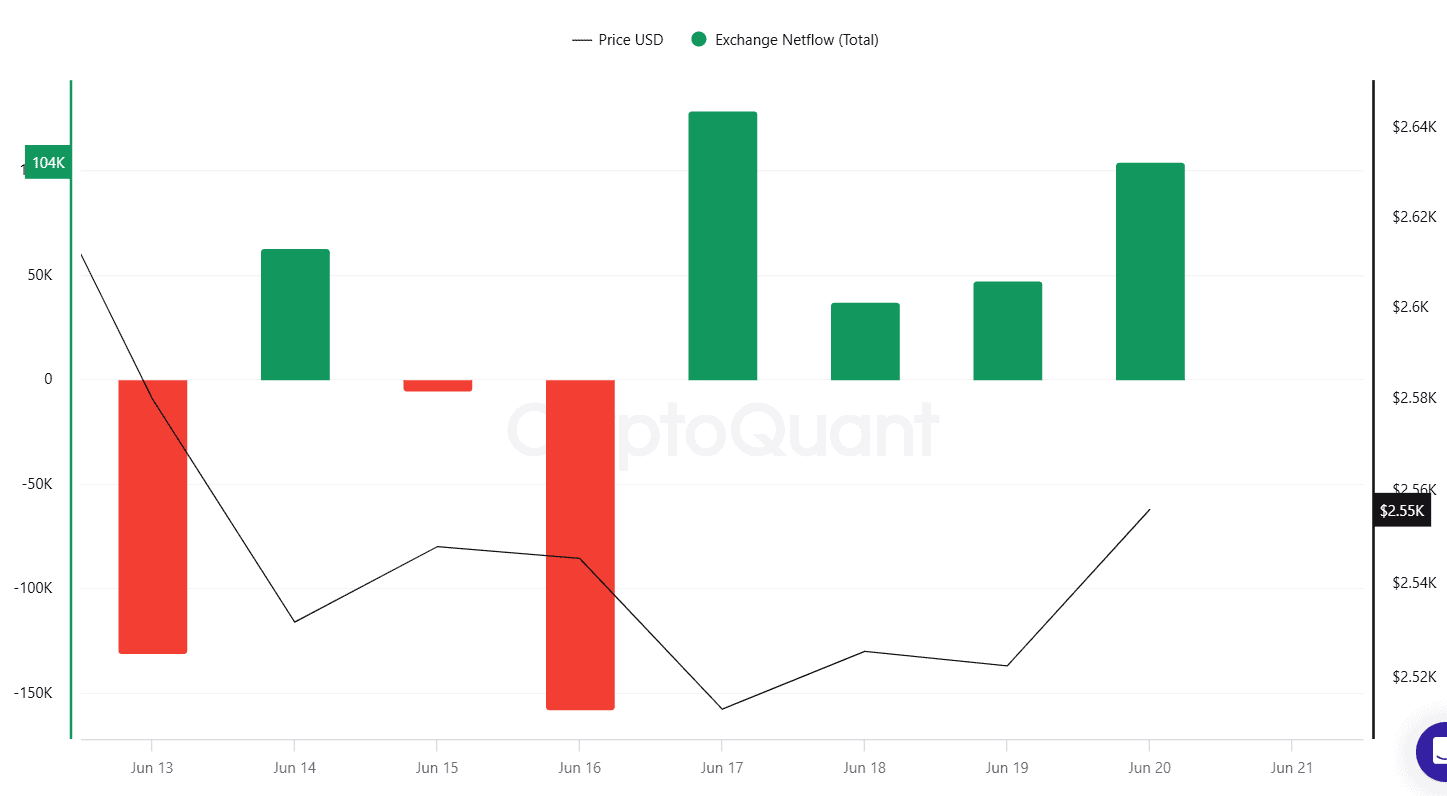

- Rising spot ETH ETF inflows reflect growing institutional interest and bullish momentum. However, recent positive exchange netflows hint at possible sell pressure ahead.

Is ETH the Right Horse?

Ethereum (ETH) has rebounded from the multi-year low of under $1,400 in April and currently trades at well above $2,500.

Its resurgence brought back optimism among industry participants, with many viewing it as an attractive investment opportunity. The X user Crypto Rover (who has over 1.2 million followers) recently argued that ETH “is the most obvious trade in 2025.”

$ETH is the most obvious trade in 2025! pic.twitter.com/NhywHpRnzT

— Crypto Rover (@rovercrc) June 19, 2025

He claimed the asset’s latest rally resembles the one from 2020, which continued until the end of 2021 when the price reached an all-time high of just south of $5,000.

Crypto Caesar touched upon ETH’s positive performance in the past hour, summarizing that “it’s looking good for now.” The analyst urged investors to remain patient, claiming that only the potential outbreak of World War III could derail the bullish momentum.

Crypto Fella believes ETH’s next rally is a matter of when not if. The X user envisions new peak levels ahead, though the price may dip before heading higher.

Those willing to explore additional recent forecasts involving Ethereum can refer to our dedicated article here.

What Are the Indicators Signaling?

Over the past several weeks, there has been an evident influx of capital toward spot ETH ETFs. Data compiled by SoSoValue shows that the last day when the netflow was negative (outflows exceeding inflows) was on May 15.

The development generally indicates that a rising number of investors have been buying shares of these funds, showcasing their confidence in the asset. Spot ETFs hold actual ETH, so these purchases can benefit the bulls.

Nonetheless, it’s not all sunshine and roses. The Ethereum exchange netflow has been predominantly positive in the last few days, suggesting that some investors have moved their holdings to centralized platforms. This is typically considered a pre-sale step and might have a negative influence on the valuation.

The post Is Ethereum (ETH) The Most Obvious Trade in 2025? appeared first on CryptoPotato.

Related Articles

Texas governor signs bill to protect state Bitcoin reserve as a permanent fund if established

Texas’ move to protect a potential Bitcoin reserve could set a precedent...

Bitcoin Bullish Divergence That Appeared Before The May ATH Has Returned Again

Bitcoin is currently hovering in a tightly compressed price range after failing...

Reddit weighs World’s scanning orbs for user verification — Report

Many users said they would delete accounts or consider moving to another...

Thai SEC opens consultation period for token issuance rules

The consultation period comes as Thailand seeks to clarify regulations for the...

Leave a comment