Top Firm Warns: Bitcoin Price Could Be Headed For A Surprise Move

The Bitcoin price and the crypto market remain under pressure as the sector enters a low volatility period. While a lot of traders were expecting a big move yesterday, following the US Federal Reserve (Fed) decision on rate cuts, the cryptocurrency held its current levels.

Despite the relative resilience in the top crypto and other cryptocurrencies, the Bitcoin price is showing signs of potential downside. At the time of writing, BTC trades at around $105,000 with a 2.3% decline over the past seven days.

Bitcoin Price’s Stuck, But Not for Long?

Analyst Daan Crypto shared insights regarding the current Bitcoin price action. The analyst believes that BTC has been compressing over the past weeks. In that sense, a lot of traders are expecting a spike in volatility.

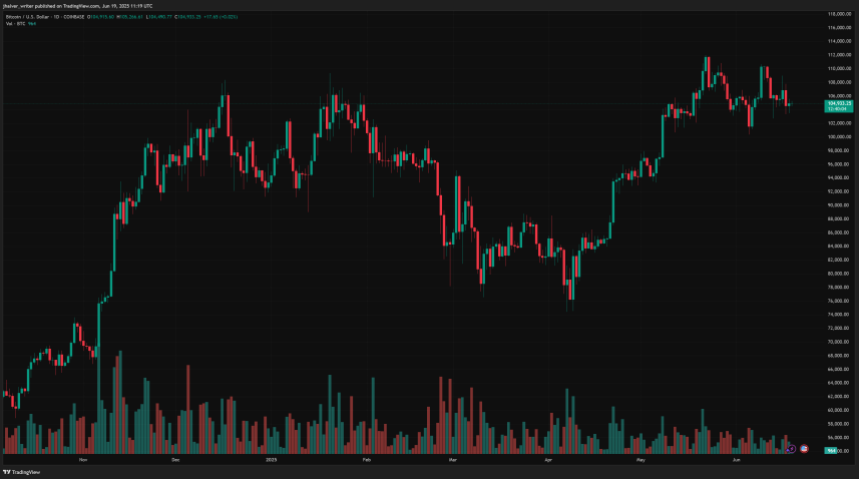

As seen on the image below, the Bitcoin price has been trading within a tight range form by its monthly high sitting at $110,600 and a monthly low at around $100,000. Within this range, there are two key levels to watch: the area between $109,000 and $103,000.

A breakout or breakdown from this range might signal the return of volatility to the Bitcoin price action. Thus, the cryptocurrency might reclaim or return to either or the previously mentioned levels on higher timeframes.

The analyst stated the following:

BTC Still hanging around the $105K area which is the middle of the monthly range and right at the monthly open. Price has been compressing and it’s clear that the market is waiting for a big move to occur. The statistics still heavily favor a further displacement this week and especially this month. So keep an eye on these levels and play accordingly.

Bitcoin Seasonality Might Shock Traders

On a separate report, trading desk QCP Capital claims that the Bitcoin price might be affected by ‘summertime blues.’ In other words, the firm predicts a decline in volatility as institutions and traders exit the market over July and August.

QCP Capital claims that there are signs of this sluggishness affecting the market, including BTC’s implied volatility. This indicator is currently sitting below 40%. In addition with a hawkish Fed, the trading desk predicts more dull price action over the coming weeks and caution amongst operators:

(…) the Fed held interest rates steady. But its stance remains hawkish. Inflation expectations are still elevated, with tariffs flagged as a key upside risk. The Fed prefers to “wait and see” until there is more clarity on inflation’s path. While some macro watchers expect softening labor and economic data to eventually push the Fed dovish, the current numbers say otherwise.

Cover image from ChatGPT, BTC/USD chart from Tradingview

Related Articles

Ex-Animoca exec loses life savings in Zoom hack tied to Lazarus

Ex-Animoca exec had his crypto wallets drained after downloading a fake Zoom...

Bitcoin critic Peter Schiff touts Silver’s potential as BTC slides

Longtime Bitcoin critic and goldbug Peter Schiff is back with another jab...

Semler Scientific plans to acquire over 100,000 BTC within the next three years

Semler Scientific plans to hold 105,000 Bitcoin by the end of 2027...

Macro Uncertainty Meets Market Balance in Bitcoin’s On-Chain Activity

Bitcoin has held steady above $104K as the typically quiet summer months...

Leave a comment