- Home

- Advertise With us

- World News

- Tech

- Entertainment

- Travels & Tours

- Contact US

- About us

- Privacy Policy

Top Insights

Bitcoin Whale And Retail Inflows To Binance Fall To Cycle Lows, More Upside Ahead?

As Bitcoin (BTC) reels amidst escalating geopolitical tensions between Israel and Iran – dropping from $110,530 on June 9 to just above $106,900 today – concerns are mounting that BTC’s upward momentum may have stalled. However, on-chain data suggests that both Bitcoin whales and retail investors still anticipate further upside for the leading cryptocurrency.

Bitcoin Whale And Retail Inflows To Binance Tumble

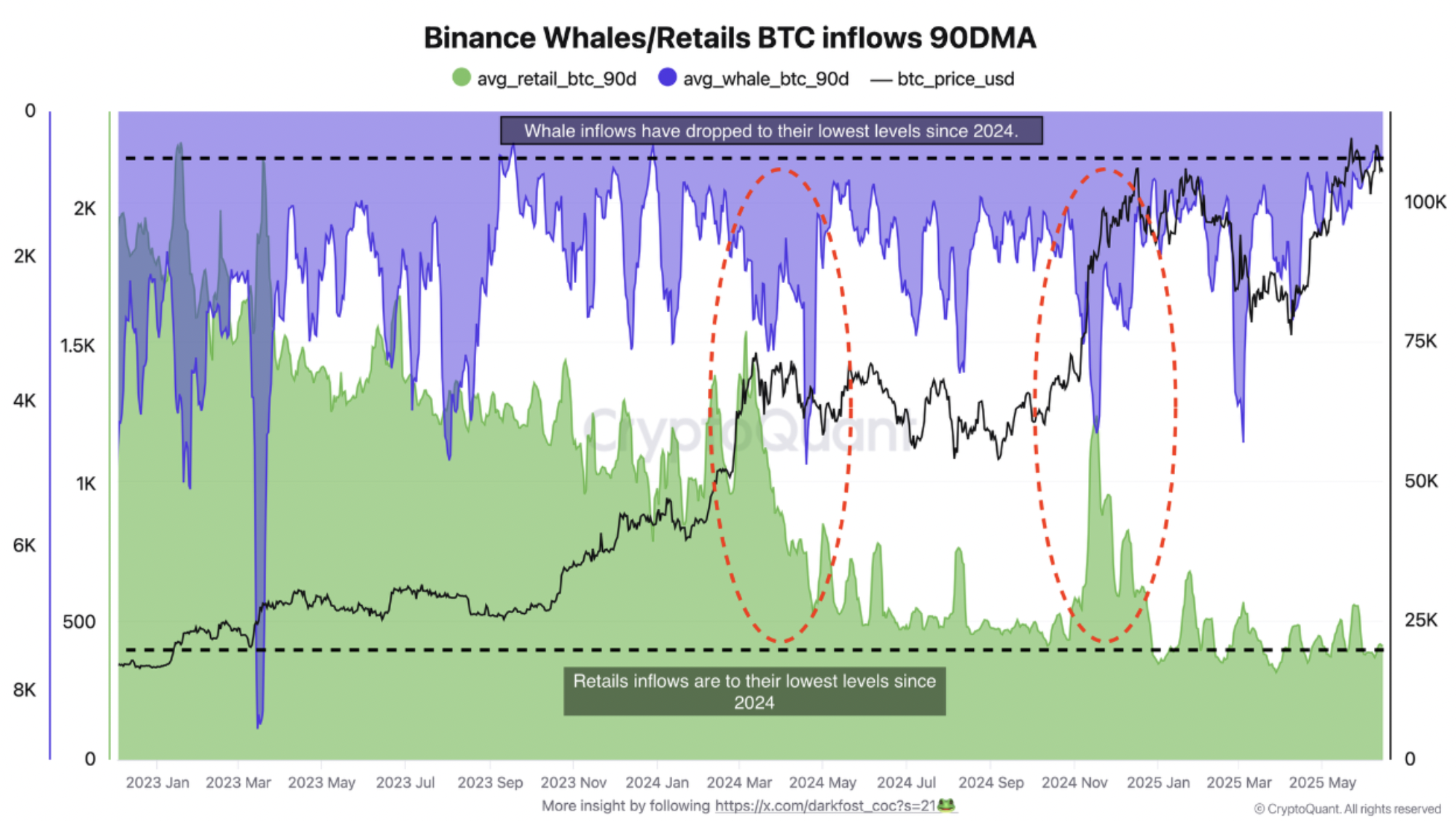

According to a recent CryptoQuant Quicktake post by contributor Darkfost, Bitcoin inflows to Binance crypto exchange from two distinct cohorts – whales and retail investors – have fallen to their lowest levels in the current market cycle.

Darkfost shared the following chart illustrating that Bitcoin whale inflows to Binance have hit their lowest point since 2024. Similarly, retail investor inflows are also at their lowest since 2024, signalling a strong preference to hold rather than sell.

The contributor emphasized that this alignment in behavior between whales and retail investors is a “highly constructive signal for the market.” Apart from the consistent inflows observed at the start of the current cycle, Darkfost identified two previous instances when both groups acted in sync.

Notably, such periods of aligned behavior have typically coincided with previous market tops. These tops were marked by synchronized BTC inflows into exchanges, leading to a significant uptick in selling pressure and, eventually, market demand exhaustion.

Commenting on the recent drop in BTC inflows, Darkfost suggested that market participants may be waiting for clearer macroeconomic cues or are simply exhibiting high conviction in Bitcoin’s long-term potential. They added:

Such alignment across investor classes may also reflect broader market confidence, with expectations of further profits ahead.

Recent trading setups support the aforementioned outlook. In a separate X post, seasoned crypto analyst Ash Crypto highlighted that a Bitcoin whale had opened a massive $200 million long position with 20x leverage.

Should BTC Holders Be Worried?

Despite the encouraging dip in BTC inflows to major exchanges like Binance, some analysts warn that a deeper correction may be imminent. For example, TradingView analyst MIRZA recently predicted that BTC could fall as low as $85,000.

Similarly, veteran trader Peter Brandt shared a cautionary note, that BTC may see a steep slide in the coming months. Brandt stated that if BTC mirrors the 2021-22 market cycle, then it may risk falling to as low as $23,600.

That said, BTC outflows from exchanges continue to rise, depleting available reserves – a dynamic that could result in a supply shock. As of this writing, BTC is trading at $106,920, up 1.8% over the past 24 hours.

Related Articles

NYSE-listed DayDayCook to raise up to $528 million for Bitcoin treasury expansion

DayDayCook’s significant Bitcoin investment could influence corporate treasury strategies, highlighting growing institutional...

Flare Network bridges XRP to DeFi to unlock dormant liquidity

Flare Network’s bridging technology and FAssets are bringing institutional and retail XRP...

Analyst Predicts Bitcoin Price Crash As War Tensions Mount In Middle East

Bitcoin’s recent price activity has been characterized by sharp swings as global...

Staked Ethereum hits 35M ETH high as liquid supply declines

Over 28% of the total Ether supply is now staked, signaling that...

Leave a comment